Vietnam has been a driver of growth in the region as manufacturing has gradually shifted from China to India and ASEAN countries. After the outbreak of the Sino-US trade war, Vietnam achieved a growth rate of about 7.4% in both 2018 and 2019. And it has successfully avoided negative growth throughout the epidemic, further demonstrating its resilience and economic potential.

The Vietnamese market seems to be full of unlimited opportunities. It is not only the manufacturing industry. With the growth of the middle class, the increase in average wealth, the rapid improvement of the business environment, the acceleration of infrastructure construction, the popularization of health and medical care, and the vigorous development of the IT industry, Vietnam is attracting the attention of everyone in the world.

From the perspective of the overall economy, Vietnam will have a population of 100 million in 2023 and continue to grow steadily. The young population with a median age of only 32.8 years (2023) promises the stability of future development. With the rapid growth of household income in Vietnam, the demand for luxury goods and services will increase, albeit from a relatively low base.

At the same time, based on the recent signing of various bilateral and regional trade agreements, under the trend of reducing trade barriers with many partners, the retail and consumer goods industry provides huge opportunities for entry. A culture of consumerism is taking root among young people, backed by the popularity of modern retail stores and the expansion of e-commerce platforms in metropolitan areas.

From a manufacturing perspective, Vietnam has a strong reputation as a major low-cost regional alternative to export-focused manufacturing. This, coupled with the country’s rapid economic growth and participation in several major free trade agreements such as ASEAN, RCEP and EVFTA, has played a major role in attracting foreign investors’ interest.

According to a report by the Ministry of Planning and Investment (MPI), Singapore is the leading source of foreign investment in 2021, followed by South Korea, Japan, China, Hong Kong and Taiwan. In 2021, the manufacturing and processing industry continued to be the largest recipient of FDI, accounting for 58.2 percent of foreign investment. For example, LG invested US$2.15 billion in Haiphong, the third largest city in Vietnam, VKPC invested US$611 million in a paper factory in Yongfu, and Far Eastern New Investment in a textile factory in Vietnam worth US$610 million.

From a healthcare perspective, the Vietnamese market offers significant opportunities for growth and development. As of November 2021, the country’s 88 million citizens were insured, accounting for 90% of its population, achieving this milestone two years ahead of schedule. The government’s goal is to achieve universal health coverage by 2030 (a very realistic goal given current trends).

However, Medicare coverage of treatments is expected to remain limited, requiring substantial co-payments. In 2019, private expenditure accounted for 55% of Vietnam’s total healthcare expenditure, and the government encourages the adoption of private insurance to reduce out-of-pocket costs. Despite the gradual decentralization of the health care financing system and the increased management autonomy of provincial medical institutions, public facilities still face challenges such as overcrowding, weak local infrastructure, and inadequate equipment. Vietnam has a lower hospital bed-to-population ratio than the global average, and efforts are underway to improve the situation.

From an infrastructure perspective, Vietnam’s new PPP Law simplifies the legal framework for private investment in infrastructure, broadens its scope and introduces standard contracts and a revenue-sharing system. Despite concerns about government guarantees and project agreements being subject to Vietnamese law, the successful allocation of the North-South Expressway section to private companies indicates a positive reception. With increased demand for infrastructure and budgetary constraints, private sector participation is expected to increase, providing growth opportunities for investors. Vietnam’s position in regional supply chains, trade agreements and economic reforms contributes to its expanding transport infrastructure.

From the perspective of the energy industry, there are still many uncertainties in the Vietnamese market. During the COP26 climate change conference in 2021, Vietnam announced its commitment to achieve net-zero emissions by 2050. However, multiple delays in the finalization of PDP-8 and its latest draft have expanded coal’s role in Vietnam’s energy mix, raising concerns that the country is truly committed to a comprehensive energy transition. However, the weight of investment in renewable energy continues to increase, and it is expected that by 2030, non-hydropower renewable energy will account for 18% of electricity generation and will exceed 70% by 2050. This is 23% higher than the revised PDP-7, which set a target by 2030. However, Vietnam is likely to meet the revised 18% target by 2030 thanks to continued investment in wind and solar projects planned to be operational within a decade.

From the perspective of the digital economy, we see an acceleration of IT development and software innovation. As more people, companies and entire countries go online and digitize, the market potential is enormous, especially through the integration of IT solutions into private and public sector operations and processes. The adoption of cloud applications and infrastructure services is expected to gain further momentum as customers increasingly bypass on-premises. At the same time, the pandemic has further accelerated trends such as e-commerce, online content and service consumption, mobile payments and remote work, which will continue to be driven by continued investments in data networks, logistics, retail and channel operations. The government’s initiatives to develop the IT services industry over the next 15 to 20 years, including the National Technology Innovation Fund, are expected to accelerate the development of local businesses. In addition, the strong purchasing power growth trend will increase the local currency affordability of imported PCs and PCs assembled locally using imported components, thereby contributing to the overall potential of Vietnam’s IT industry.

我們希望與想在國際市場發展,且產品與服務具有相應潛力的企業合作,倘若你對於與我們討論有興趣,歡迎直接跟我們聯繫。

Vietnam’s economic growth in recent years has been nothing short of impressive, with the country showing resilience amidst the challenges posed by the global pandemic and the Sino-US trade war. The country’s proactive approach to foreign trade, infrastructure development, and business-friendly policies have driven its economic expansion, over the last decade GDP growth in Vietnam has consistently been about twice the world average, apart from 2021 where it suffers a flux of Delta variant that dampened operations, affecting its growth rate.

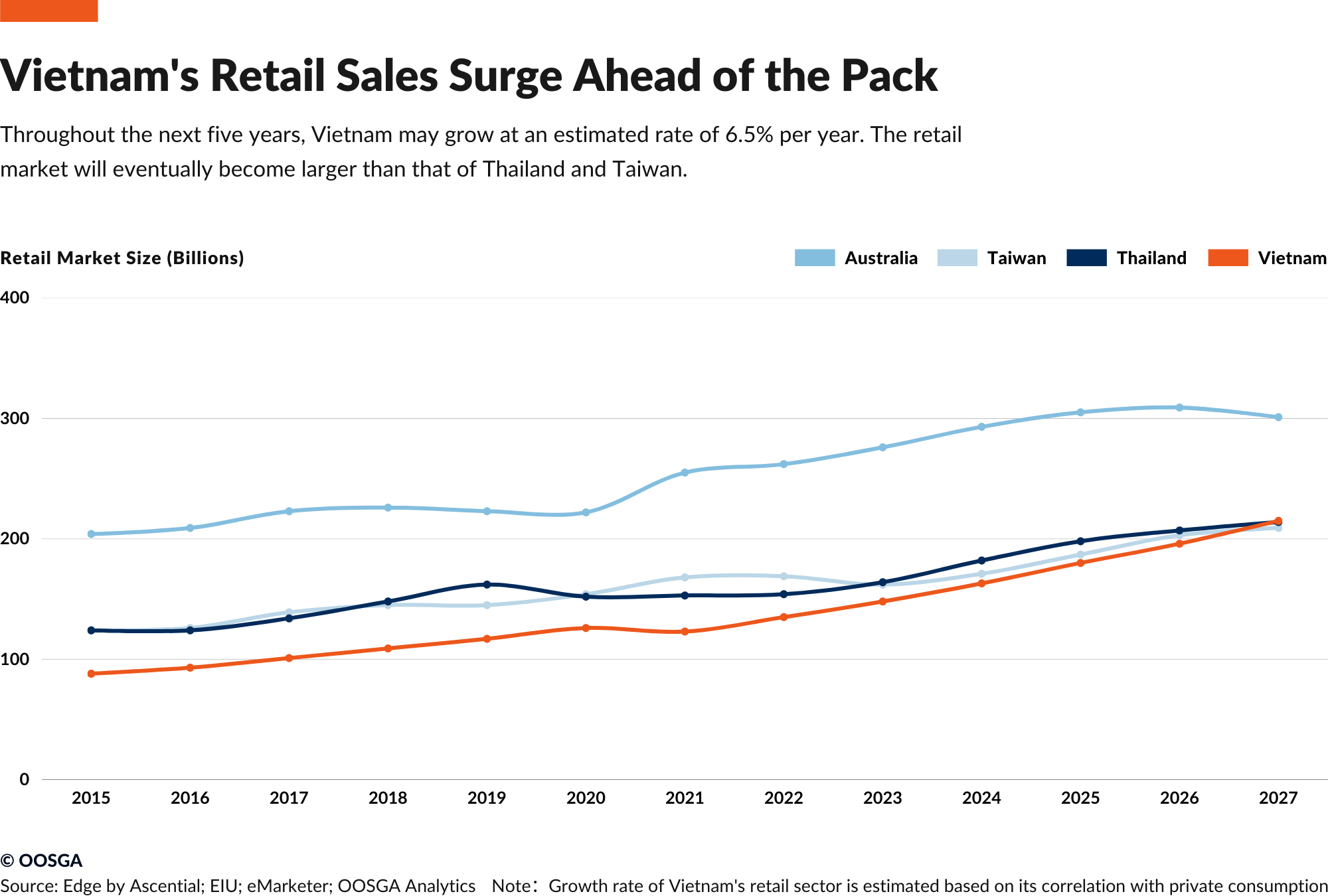

With a strong economic growth and a growing middle class, the country’s retail market will grow from 135 billion dollars in 2022 to an estimated 215 billion dollars in 2027; An 80 billion dollars opportunity that is up for grab in the next five years. The size of retail will eventually become larger than that of Taiwan and Thailand, despite a smaller economic size.

With a population of 100 million, Vietnam is the 3rd most populous country in Southeast Asia, only after Indonesia and the Philippines. With a healthy fertility rate and 2.1 and an advantageous demographic structure, there will be a working population that increases over the coming years.

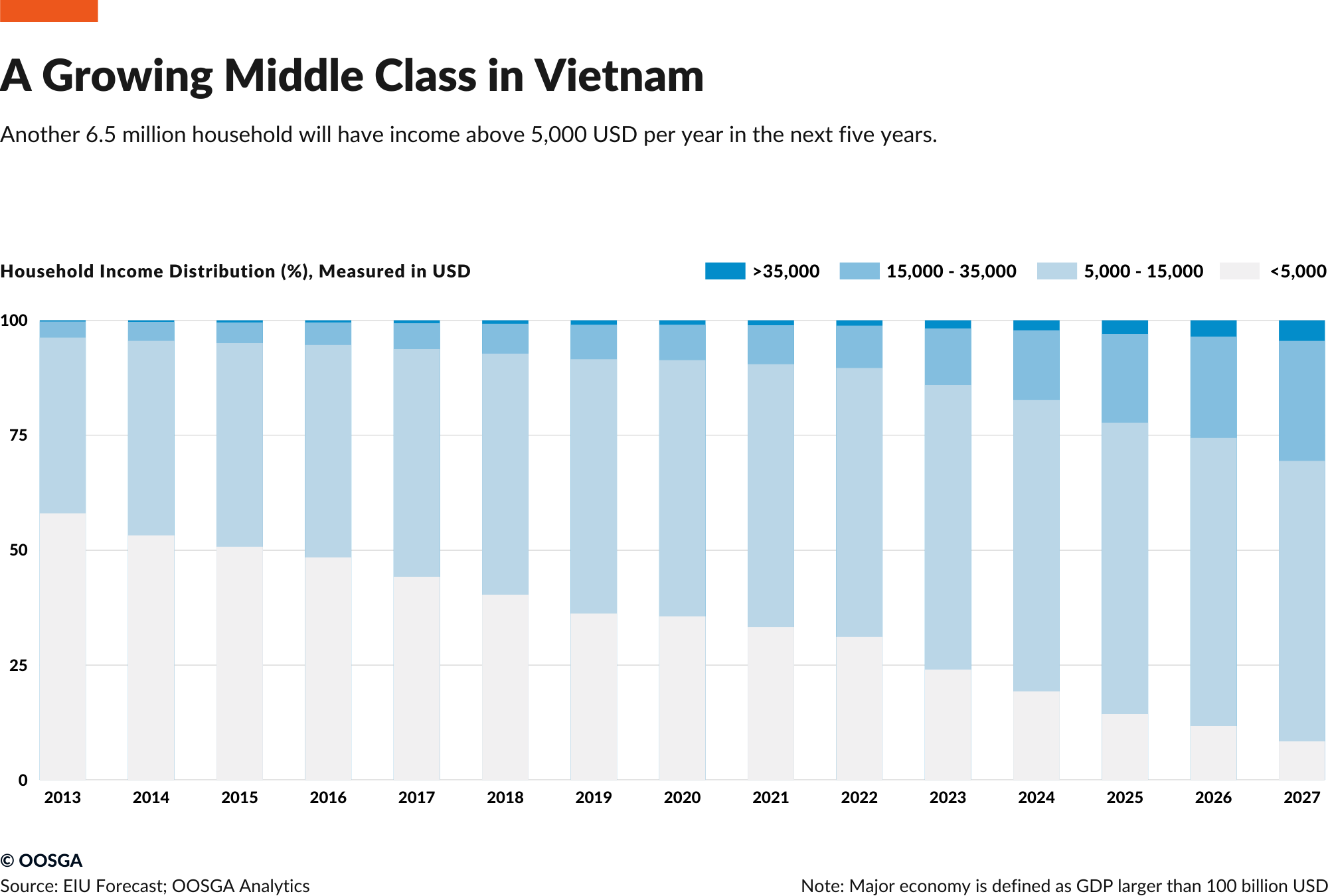

As the economy of Vietnam is reaping the demographic dividend, more and more people are getting richer as a result. From spending perspective, data from World Data Pro, an Austrian intelligence firm, has suggested that there will be an additional 36 million Vietnamese that spends more than 11 dollars a day, in the next decade.

Also, household income data has also suggested in the coming five years there will be an additional 6.5 million household with more than 5,000 USD disposable income.

Although in 2023, affected by international trends, Vietnam's export-oriented economic growth will be suppressed, and the double blow of inflation and unemployment in recent years will also affect growth. According to the latest statistics from the Vietnam Statistics Bureau, it is also found that, Major industrial areas such as Dong Nai, Binh Duong, Bac Ninh, and Bac Giang have suffered unemployment of 10,000 to 30,000 people, an increase of 18% compared to the previous quarter.

However, its huge advantages in Southeast Asia and the government's fixed investment will support the growth in the next few years. It is expected to maintain a growth rate of about 6.7% in the next five years, much higher than the regional average.

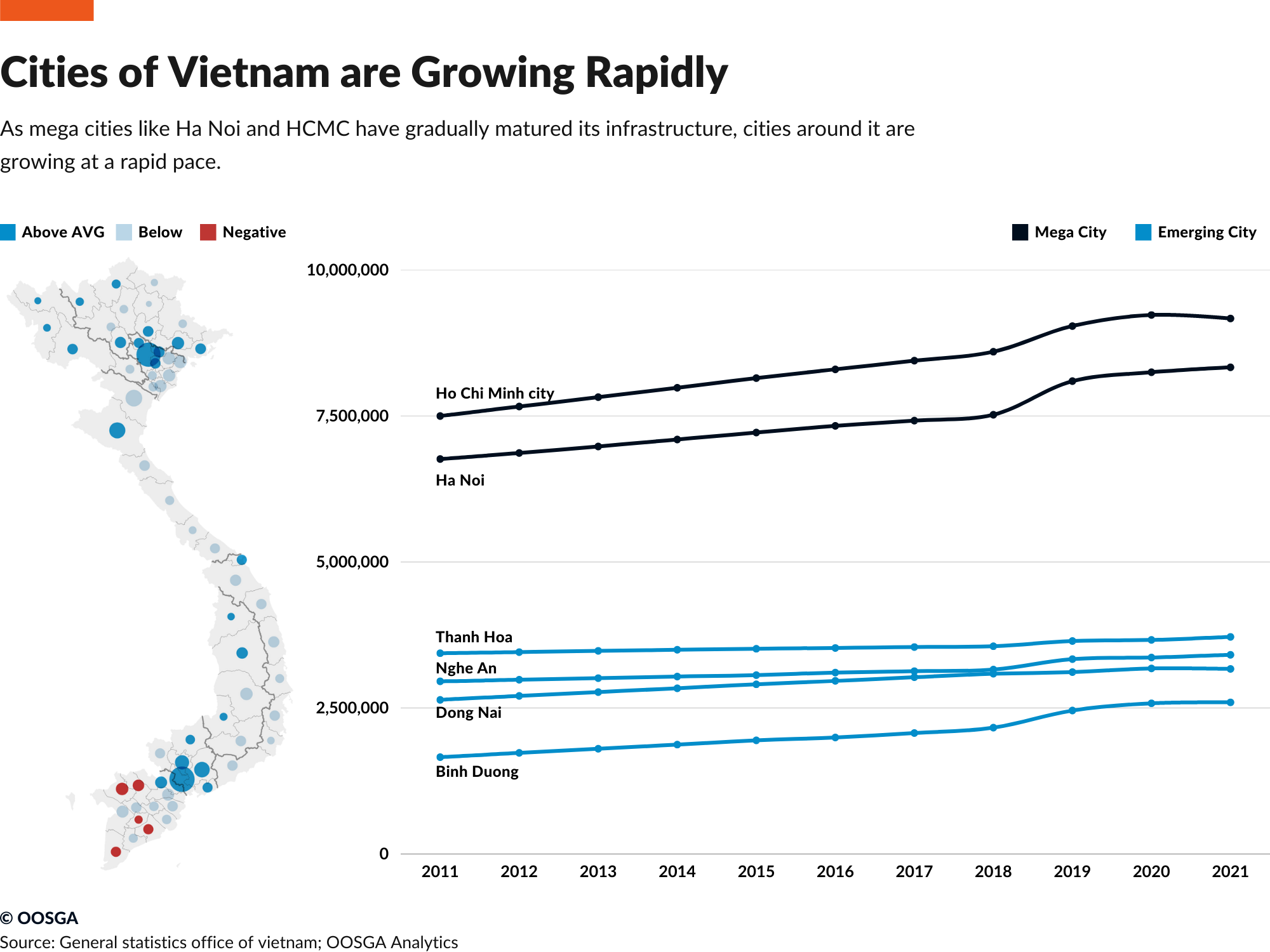

Although the current national market development is still dominated by the two major cities in the north and south, Ho Chi Minh and Hanoi, we have also found that other cities surrounding these two major cities are also growing at a rapid rate.

As the economic center of Vietnam, the Southeast region in the south has Ho Chi Minh City, the commercial center of the country. Between 2011 and 2021, the region's population growth rate reached 23.80%, much higher than the national average. This is mainly due to the vigorous development of economic activities in the region, as well as the rapid increase of various investment projects. Vietnam's industrial development in recent years has been particularly prominent in this region. Factors such as low labor costs and superior geographical location have attracted a large number of international companies to invest and build factories here. These enterprises have brought a large number of employment opportunities to the local area, so that more and more people choose to settle here, which in turn promotes the population growth of the area. According to statistics, the population of the Southeast region has increased from 14.79 million in 2011 to 18.31 million in 2021.

Taking foreign direct investment as an example, Binh Duong, north of Ho Chi Minh City, absorbed a total of US$31.7 billion in foreign direct investment in 2018, almost equal to Hanoi and equivalent to the sum of Shanghai and Beijing. This speed accelerated the development of the city. Binh Duong's population growth rate is almost five times that of the whole country and twice that of Ho Chi Minh City.

The days of focusing only on Hanoi and Ho Chi Minh City, if not in the high-end luxury segment, are over, with local players now targeting consumers in rural areas of multiple cities, so companies that only serve the two largest cities will need to expand their approach. To reach the roughly 50 percent of the population with annual incomes above $15,000, companies typically need to distribute their products to a dozen relevant cities from north to south.

The manufacturing industry generally provided by Vietnam is still highly labor-intensive and low-tech. Among them, textile has also become the largest manufacturing category in the country. According to the data released by the Bureau of Statistics in 2019, nearly half of the manufacturing output comes from the manufacture of textiles, which is much higher than many markets.

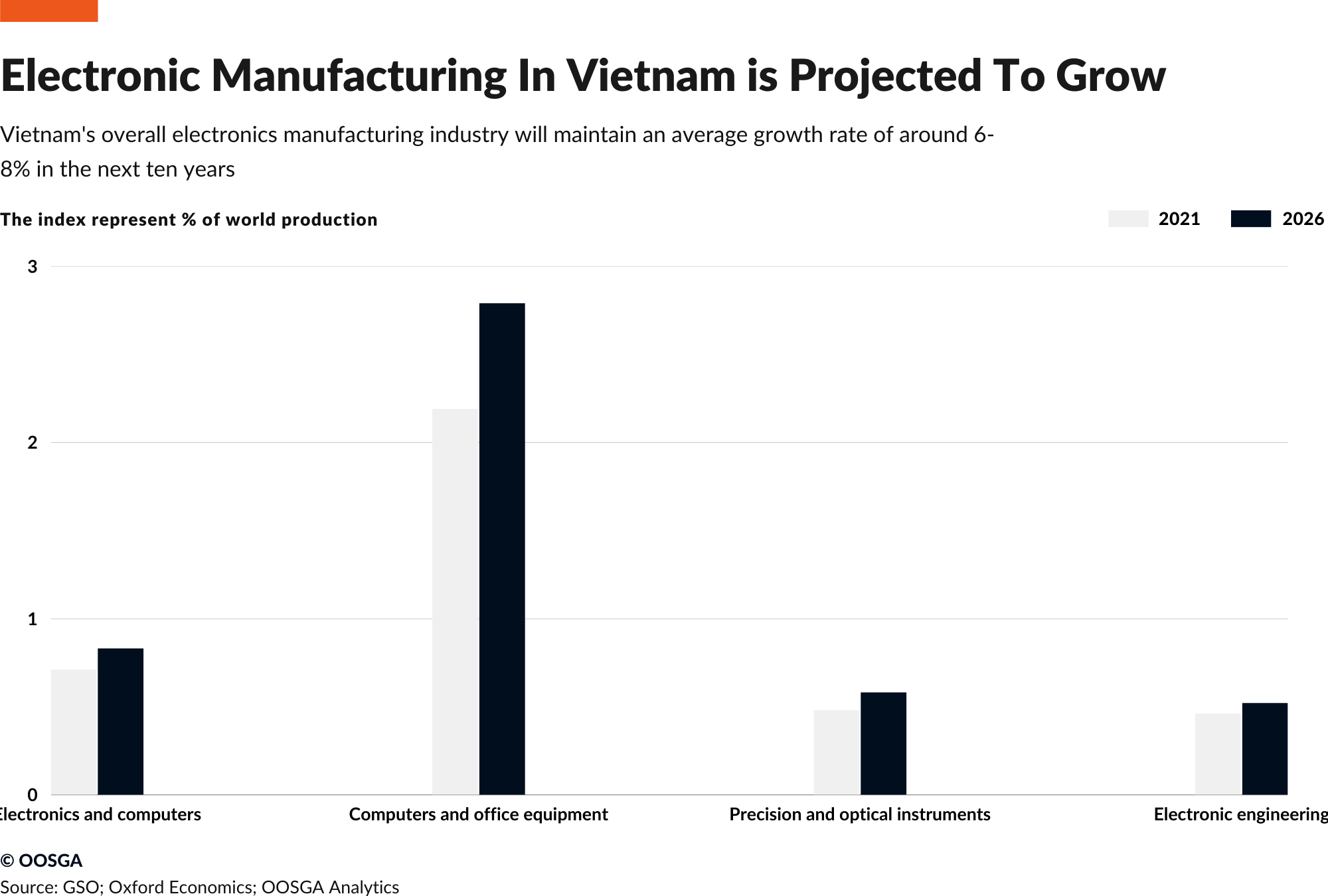

However, in the next few years, electronic parts and products will play a more important role in the growth of Vietnam's manufacturing industry. From 2016 to 2020, it will not only maintain an average annual growth rate of 23%, except for the export of electronic products in 2023. In addition to the cold winter, it will also achieve a growth rate of about 8% in the next few years, and double the output value to 20 billion US dollars before 2030 (2015 US dollars, Oxford Economics).

From the perspective of the manufacturing industry, Vietnam currently not only has solid business conditions, infrastructure construction, and a gradually improving supply chain. In recent years, the Vietnamese government has also successively introduced many favorable investment promotion policies, especially focusing on large-scale manufacturing projects and High-tech manufacturing.

According to Law No. 32/2013 and Decree No. 218/2013, large-scale manufacturing projects that meet any of the following conditions may qualify for a corporate income tax (CIT) rate of 10% for 15 years, a four-year tax holiday and a 50-year tax holiday Percentage of tax reduction for the following nine years: (1) Enterprises must invest at least VND 6 trillion (approximately US$ 300 million) within three years after obtaining the investment registration certificate, and realize at least VND 10 trillion (approximately 4.5 billion USD) for three years after generating revenue, or (2) enterprises must invest at least VND 6 trillion and employ at least 3,000 full-time employees within three years after obtaining the certificate. In addition, the investment project must be located in a rural area, employ at least 500 people, or be initiated by a high-tech company or technology enterprise.

According to Law No. 32/2013 and Vietnam's new investment law (61/2020/QH14, promulgated in mid-2020 and effective in January 2021), the above incentives are not applicable to mining projects and goods subject to special sales tax and service production (excluding the manufacture or assembly of motor vehicles).

Decision No. 29/2021/QD-TTg issued by Prime Minister Pham Minh Thanh in October 2021 introduced special incentives for large-scale projects. The three schemes offer various benefits such as extended tax rates, tax holidays and land and water rent exemptions. These incentives are available to companies involved in high technology, supply chain, technology transfer and production of goods with significant added value.

Option 1: Qualified projects enjoy a 9% tax rate for 30 years, first exemption for 5 years, tax reduction of 50%, tax reduction for 10 years, land and water rent tax exemption for 28 years, and tax reduction of 55% for the remaining project duration. Eligible projects under Scheme 1 include projects with a capital of at least VND30 trillion (approximately US$1.3 billion), one-third of which is disbursed within three years of investment approval.

Option 2: The project enjoys a tax rate of 7% for a period of 33 years, with tax exemption for the first 6 years, followed by a 50% tax reduction for 12 years, and a 20-year tax exemption for land and water surface rents, which will be reduced after 65%. Option 2 projects involve innovation centers and R&D investments of at least VND 3 trillion (approximately US$130.4 million) (disbursement of VND1 trillion or approximately US$43.5 million within three years of investment approval). This also includes various high-tech, supply chain and technology transfer projects, as well as projects with added value accounting for 30%-40% of the total production cost.

Option 3: Enterprises enjoy a 5% tax rate for 37 years, with an initial 6-year tax exemption period, followed by a 50% tax reduction for 13 years, a 22-year exemption from land and water surface rents, and a 75% reduction in the remaining part of the project. Option 3 incentives are available for enterprises involved in high-tech, supply chain, technology transfer and commodity production with at least 40% added value within the National Innovation Center Park (see sector-specific incentives).

Laws such as the Investment Law ( 61/2020/QH14 ) and Law No. 71/2014/QH13 also expand the list of sectors and industries that are entitled to tax relief or subsidies. Including high-tech, scientific research, technology development, national infrastructure, and computer software manufacturing and other fields. Other industries eligible for incentives include industries whose products support high-tech enterprises, production of new materials, new energy and renewable energy, production of electronic products, production of key machinery products, agricultural machinery, automobiles and auto parts, shipbuilding, etc.

Among them, a series of stimulus policies that are beneficial to manufacturers have also been gradually proposed in the past 5-10 years, such as:

According to the requirements of Law No. 48/2010/QH12, Announcement No. 83/2016/TT-BTC exempts the projects of "specially encouraged industries" from paying non-agricultural land use tax. In addition, Decree No. 57/2021 (published and effective June 2021) provides incentives for manufacturing projects that support the above industries, even if they start operating before 2015.

Law No. 04 /2017/QH14 aims to support Small and Medium Enterprises (SMEs) and start-ups by providing various incentives, such as corporate tax exemption for SMEs investing in distribution chains, access to credit guarantees, and office/experimentation for incubators office space, simplify the accounting system, provide free consulting services and staff training, and waive business registration fees.

Decree No. 13/2019/ND-CP also provides incentives for scientific and technological enterprises that derive at least 30% of their revenue from inventions, practical solutions, industrial designs, integrated circuits, new technologies, and new livestock, plant, and aquatic species. These businesses are eligible for a four-year corporate income tax exemption and a nine-year 50% reduction in payable corporate income tax. They are also eligible for waived or reduced land use rights fees and can apply for government grants.

Finally, Decree No. 94/2020/ND-CP provides incentives for tech start-ups operating in several parks of the National Innovation Center (NIC). Incentives include exemption from land rent for the entire lease term, which can be up to 50 years. Startups located in the NIC park in Hoa Lac may also qualify for a 10% income tax break for 30 years from the first year of income, followed by four years of income tax exemption and 50% income tax reduction for up to nine years.

Vietnam's health and medical market has grown significantly in the past few years, with the increase in national per capita income and the Vietnamese government's active promotion of medical popularization. The growth rate of per capita medical expenditure has increased from 2015 to 118 US dollars, growing to 280 US dollars in 2022, the growth rate is much higher than the per capita GDP.

In 2022, the total expenditure on health care will not only be as high as 27.9 billion US dollars, but it will also grow from 4.57% in 2015 to 6.8%. This ratio is not only extremely high from the perspective of developing countries, it is also the highest in ASEAN, and it is higher than Singapore's 5%.

This growth rate is not only due to the epidemic, but the popularization of public health insurance, population aging, income increase, and the continuous expansion of private health insurance have also contributed to the considerable growth. In the medium and long term, population aging will be the main driver of Vietnam's healthcare expenditure.

Furthermore, although the government is actively promoting the development of generic drugs to increase the popularity of drugs, due to Vietnam’s concessions on tariffs in participating in various trade agreements, the growth of imported original drugs with higher prices continues .

According to the latest WHO statistics, the government accounted for about 45% of Vietnam's health care expenditure in 2020, and this ratio has also seen a significant increase. The average in the 2000s was about 35%, and it grew to 43% in the 2010s. %, and after 2020, due to various factors mentioned above, as well as the Vietnamese government's continuous promotion of national health insurance, we also expect this value to continue to grow.

Private expenditure accounted for 54% of Vietnam's current total healthcare expenditure in 2020 (WHO), while out-of-pocket (OOP) expenditure accounted for 40% of current healthcare expenditure. In order to reduce OOP expenses, the Vietnamese government also encourages people to purchase private insurance, especially in wealthier regions.

According to the Vietnam Pharmaceutical Companies Association, there are about 1,000 pharmaceutical companies in the country, 30 percent of which are foreign-owned companies. In Vietnam's pharmaceutical market, imported drugs account for more than 50% by value, while slightly more than one-fifth of locally produced drugs are produced by foreign-funded enterprises. With the increasing cooperation between domestic and foreign companies, the two continue to use their respective advantages to enhance common market sales.

It is generally expected that the Vietnamese pharmaceutical market will grow rapidly in the next few years. Over the next decade, prescription drugs will continue to dominate, especially for the treatment of infectious and chronic diseases. The over-the-counter drug market could get a boost from reclassification of popular traditional medicines, although there are no concrete plans yet. Market data may continue to be distorted by the blurred distinction between prescription and over-the-counter drugs.

Vietnamese pharmaceutical companies account for 50% of the entire pharmaceutical market, while about 60% of the country's pharmaceutical end products and 90% of active pharmaceutical ingredients used in pharmaceutical production are imported. In recent years, the government has been trying to reduce its dependence on imports. As part of the government's macro strategy on health care, the government plans to allow local pharmaceutical companies to meet domestic drug demand through tender incentives and other measures.

Although the government aims to increase the domestic drug market share to 80%, Vietnam currently still relies on imports for about 55% of its annual drug demand. In 2021, imports will reach nearly $4 billion. One of the reasons why Vietnam relies on imports is that domestic companies generally lack R&D capabilities and cannot meet the high-quality generic drugs required by EU-GMP or PIC/S-GMP Production standards. In addition, more than 90 percent of medicines imported by Vietnam come from overseas, half of which come from mainland China.

Recently, pharmaceutical companies from Spain, Poland, Italy and Hungary have been given equal opportunities to enter the Vietnamese market. Well-known pharmaceutical companies such as Abbott of the United States, Taisho Pharmaceutical of Japan and Sanofi of France have been operating in Vietnam for many years, and some companies have even entered the market for decades. Selling their products nationwide, they are also investing in new factories and R&D facilities. The top 10 Vietnamese pharmaceutical companies include TV. Pharma Pharmaceutical JSC, Hau Giang Pharmaceutical JSC and Traphaco JSC.

In recent years, with the continuous increase of merger and acquisition activities, many foreign investors have purchased a large number of shares in Vietnamese pharmaceutical companies. These moves broaden market access for foreign companies and help circumvent restrictions on foreign direct investment. For domestic companies in Vietnam, this integration brings more R&D opportunities and allows companies to share expertise, best management practices, and opportunities to expand overseas.

Vietnam's first law on public-private partnerships (PPPs) came into effect on January 1, 2021, marking a major turning point in the country's approach to PPPs. With a more streamlined legal framework, Vietnam will attract more private investment in infrastructure.

The new PPP law expands the scope of industries that allow PPPs to include transportation, electricity transmission, power generation (except hydropower), irrigation, clean water supply, drainage, sewage and waste treatment, healthcare, education, and IT infrastructure. In addition, the law also A standard contract and revenue sharing system was introduced for PPP. Although the PPP law has made great strides in attracting private investment into infrastructure, it has raised concerns due to the lack of clear guarantees of government commitment to state-owned enterprises and the mandatory requirement that project agreements be governed by Vietnamese law rather than British law. investor concerns or Singapore law in previous cases). Nonetheless, given the government's past favorable attitude towards foreign investors, the number of PPPs in the infrastructure sector is expected to increase. Under the new PPP law, three sections of the North-South Expressway were successfully allocated to the private sector between May 2021 and August 2021, a further sign of investors' positive reception to the legislation.

From the past, the Vietnamese government has been the main sponsor of the country's transportation infrastructure. While the private sector has been allowed to build roads and ports, several other sectors, such as railways, airports and pipeline infrastructure, remain state monopolies. However, governments' ability to finance infrastructure projects will be constrained by budgetary constraints, rising public debt, and the need to prioritize health and social spending during the pandemic. As a result, private sector participation in the country's infrastructure development is expected to increase substantially. The Concurrent Power Development Plan (PDP-8) outlines the national road, railway and seaport development plan for 2021-2030, with 157 approved projects covering various economic sectors with a total investment of US$71.4 billion FDI for 2021-2025 The investment marks a major shift in government strategy. This presents strong growth opportunities for domestic and international investors.

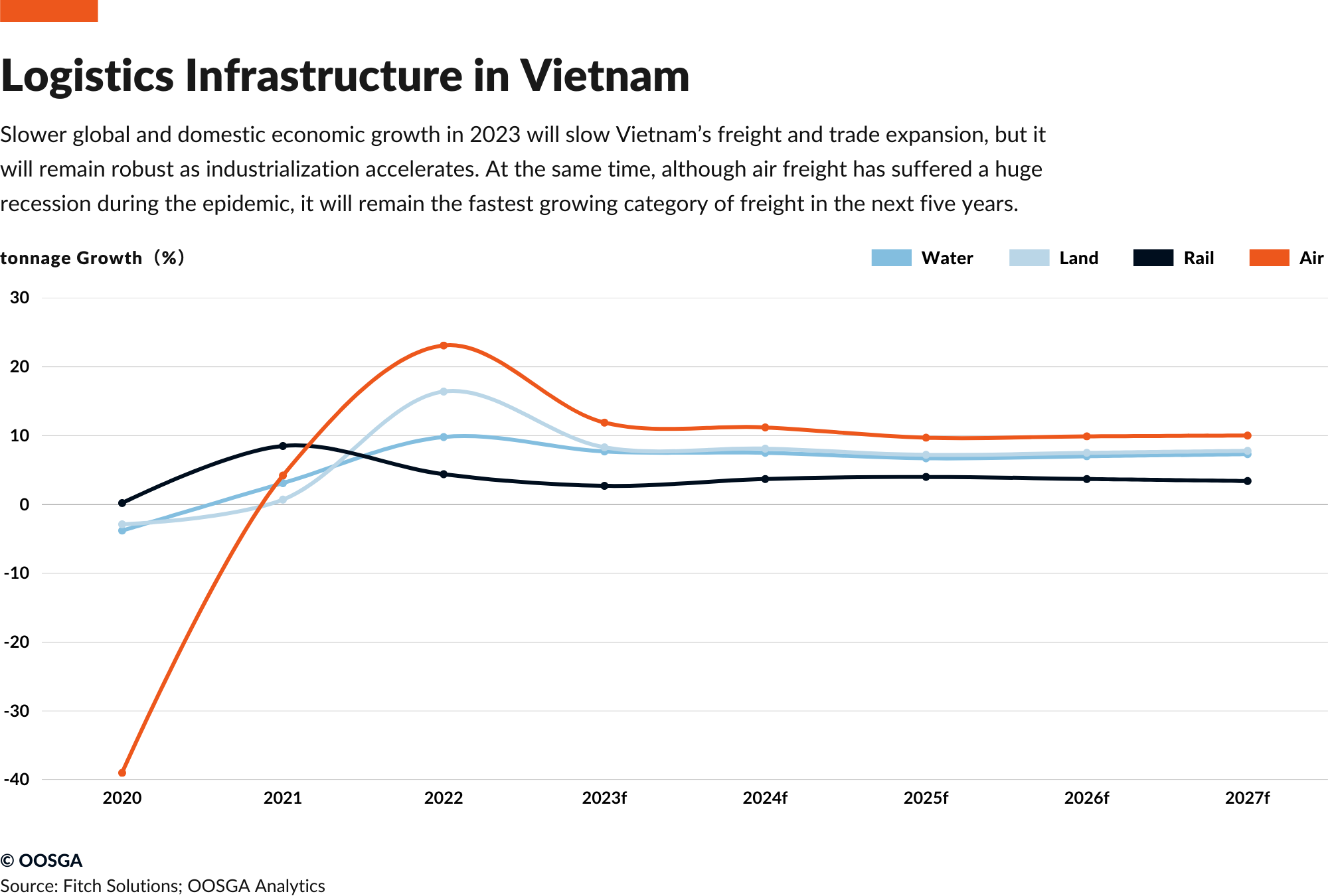

Vietnam's booming trade and increasing foreign direct investment have also led to significant growth in the country's transport infrastructure. As one of the most promising consumer markets in the Asia-Pacific region, Vietnam has experienced rapid economic growth, prompting the need for improved freight services and infrastructure to meet growing demand. Over the medium-term forecast period, Vietnam's real trade growth is projected to average 8.5% year-on-year between 2022 and 2026, further underscoring the need for infrastructure improvements.

The country's efforts to liberalize trade and participate in regional and international trade agreements have helped expand its transport infrastructure. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) have strengthened Vietnam's trade relations with several countries, creating positive prospects for Vietnam's trade and infrastructure development until 2026.

Infrastructure improvements are crucial as Vietnam positions itself as a viable alternative to China in regional supply chains. The country's geographical location and extensive network of free trade agreements put it in a good position to benefit from the ongoing trade dispute between the US and China. The government implemented reforms to open up the economy, accelerated the privatization process of state-owned enterprises, and achieved a steady pick-up in real GDP growth.

Vietnam is rapidly expanding its renewable energy infrastructure, focusing on non-hydro renewables. According to the National Power Development Plan 8 (PDP-8), the share of non-hydro renewable energy generation is expected to reach 18% by 2030 and exceed 70% by 2050. This is 23% higher than the revised PDP-7, which set a target by 2030. However, Vietnam is likely to meet the revised 18% target by 2030, thanks to continued investment in wind and solar projects that are planned to be operational within a decade.

In October 2022, the Ministry of Industry and Trade (MOIT) issued Circular No. 15/2022/TT-BCT outlining the price range for electricity generated by transitional wind and solar projects. The projects have signed a power purchase agreement (PPA) with Electricity of Vietnam (EVN), the country's largest state-owned power company, but are not eligible for the 2021 feed-in tariff (FIT). Circular 15 is expected to address tariffs for as many as 62 wind and solar projects with a combined capacity of 3.9 GW. Transitional PPAs and tariffs are valid until 2025, after which the projects can participate in auctions.

Hydropower is expected to account for about 29% of Vietnam's electricity generation by 2022, reaching about 78,600 GWh. Although installed hydropower capacity grows by about 0.6% per year, its contribution to the country's electricity generation is expected to decline to around 20% by 2032.

Wind power is also gaining momentum in Vietnam. In 2022, the national installed wind power capacity will increase from 750 MW to 950 MW. The draft PDP-8 proposes adding 5,000 MW of onshore wind and 3,000 MW of offshore wind by 2030, a target considered achievable within that time frame. The Vietnamese government offers wind power developers a tax exemption for the first four years of operation, followed by a 50% tax cut for the subsequent ten years.

The two proposed offshore wind farm projects, Thang Long and La Gan, will be the largest offshore wind farms in Asia when completed, with an installed capacity of 3,400 MW and 3,500 MW, respectively. In November 2021, Denmark's Orsted announced plans to invest $1.2-13 billion to build a 3,900 MW wind farm, which will be Asia's largest offshore wind project, about 14 kilometers southeast of Bach Long Vy island. Additionally, in July 2022, US energy utility AES Corporation revealed plans to develop a 4,000 MW wind farm in Binh Thuan Province, a central Vietnamese province.