Connect With Authors

*Your message will be sent straight to the team/individual responsible for the article.

In 1945, Indonesian Republican forces, under the leadership of Sukarno, the country’s first president, proclaimed independence from the Netherlands. Sukarno’s rule ended in 1967 when General Suharto overthrew him in a coup, following a near-total economic failure. Suharto’s reign, which lasted for three decades, was characterized by authoritarianism until he was compelled to step down in 1998 due to an economic and societal crisis. Subsequently, Indonesia underwent a significant political transformation called the reformasi period, leading to a more democratic governance structure and the implementation of direct presidential elections. In 2014, Joko Widodo, also known as Jokowi, was elected as Indonesia’s seventh president, marking the first time a president was elected from outside the conventional political elite.

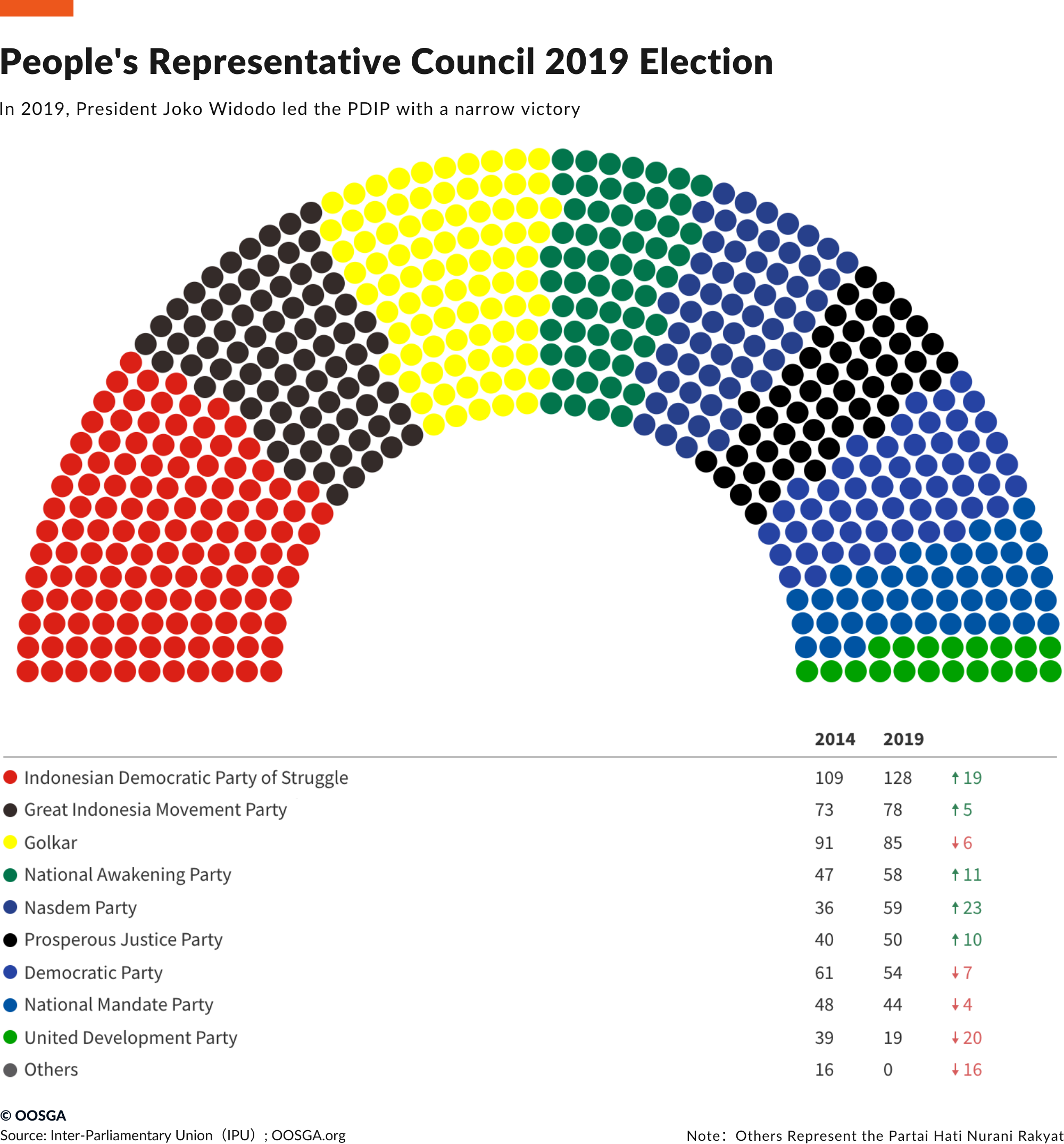

In Indonesia, the political structure underwent significant reforms, particularly since the fall of Suharto in 1998. Since 2004, both the president and vice-president are elected directly by the people, a remarkable shift from the previous system. The People’s Consultative Assembly (MPR), which is the country’s legislative body, consists of the 575-member House of People’s Representatives (DPR) and the 136-member Regional Representatives’ Council (DPD). With the implementation of these changes, the role and authority of the DPR were greatly enhanced, marking a departure from the concentrated power that characterized earlier eras of Indonesian governance.

The political reforms also extended to the synchronization of presidential and legislative elections, beginning in 2019. This change aimed to streamline the electoral process and ensure greater alignment between the executive and legislative branches of government. Furthermore, the decentralization of power and the development of local governance structures have played a key role in shaping contemporary Indonesian politics. Overall, these changes have ushered in a more democratic and transparent political system, reflecting Indonesia’s ongoing commitment to political reform and development.

As the global prices for commodities, including oil, are expected to stabilize in 2023, Indonesia is likely to experience a continued easing in consumer price inflation. The government will gradually reduce policies that have been primarily aimed at mitigating the impact of inflation. During 2022 and early 2023, these policies, which have been at the forefront of the government’s agenda, included targeted support like welfare aid and subsidies for low-income families.

The Job Creation Perppu will be implemented to reduce labor costs and bureaucratic hurdles for investment, reflecting President Jokowi’s increasing concern about the potential negative global economic outlook in 2023 that might affect growth. Though some question the strength of Indonesian democracy in light of Jokowi’s intervention, it is anticipated that the government will craft legislation to enable most elements of the Job Creation Perppu to take effect by 2023’s end. Infrastructure will continue to be prioritized, but projects may not meet all their targets. This includes the delay of the new national capital’s completion in East Kalimantan until at least 2025 and minimal impact on Jakarta’s congestion. Significant infrastructure focus will remain on Java and Sumatra, including the launch of Indonesia’s first high-speed railway between Jakarta and Bandung in June 2023, which aims to decrease transportation and logistics costs.

During the final year of Jokowi’s term, efforts to attract foreign direct investment will intensify, concentrating on areas like downstream processing, manufacturing, and sustainable infrastructure. These investments are expected to be pivotal for mid-term economic growth, especially in industries related to electric vehicle components. The government’s commitment to combating climate change will continue, with initiatives like the introduction of a carbon trading scheme and a carbon exchange anticipated in the second half of 2023. Subsidies to encourage the purchase of electric vehicles are also expected to become a lasting part of the country’s policy during the forecast period.

12.67 Billion

1 %

-2.3 %

40.1 %

The parliamentary and presidential elections in Indonesia are slated to occur together in February 2024. The center-left PDI-P, which currently holds the most seats in the legislative body, is expected to remain the largest party in the House of People’s Representatives. Public surveys show that PDI-P consistently leads its closest competitors, Golkar and Gerindra, which have a more right-wing political stance. In Indonesia, political patronage networks prevent significant changes in party support from one election to another, although presidential voting preferences are less influenced by party lines.

The presidential nominees will not be finalized until 2023, but it is believed that the election will be won by one of three individuals: Ganjar Pranowo, the governor of Central Java, Anies Baswedan, the former governor of Jakarta, or Prabowo Subianto, the current defense minister and a previous presidential candidate. Although PDI-P is considering Puan Maharani, the speaker of the People’s Representative Council, as its presidential nominee, it is expected to ultimately support Pranowo due to his greater popularity and status as a non-establishment figure. Conversely, Maharani’s connections to a political dynasty may not be well received by some voters and could drive them towards Subianto of Gerindra. The National Democratic Party has endorsed Baswedan’s presidential bid, but since the party does not have enough seats in the legislative body to nominate a candidate, it will seek support from smaller parties in order to secure his participation, likely by the end of 2022. Opinion polls have consistently shown Baswedan to be the front-runner, slightly ahead of Pranowo.

-

31

Indonesia’s business environment has shown significant improvement over the past few years. This enhancement is evident in its global position. Not only is it attracting more and more foreign investment as a percent of ASEAN, it has also been heavily promoting laws & regulations that will improve doing business in the country. Factors contributing to this overall increase include positive changes in the labor market, taxation policies, attitude towards private enterprise, market opportunities, and the political landscape. However, there will be some deterioration in the category related to the macroeconomic environment. Infrastructure, historically a weak area for Indonesia, is expected to see marked improvement in the coming years.

The country’s large consumer market ensures strong performance in its market opportunities. Despite a slip in the macroeconomic environment and a relative lag in recovery from the disruption of the coronavirus pandemic, efforts by Indonesia’s Ministry of Finance to reduce and simplify the tax burden will yield positive results in this period. On the political front, the country’s democracy remains relatively young and faces challenges. President Joko Widodo (known as Jokowi) will continue to lead until 2024, providing stable governance. However, his ability to implement political reforms may be constrained by a coalition with varied objectives, and opposition to his technocratic approach. This political balancing act will require careful navigation to appease different groups while pursuing the administration’s goals.

-

47

1.18 $

0.6 $

196 $

2.2344 %