Connect With Authors

*Your message will be sent straight to the team/individual responsible for the article.

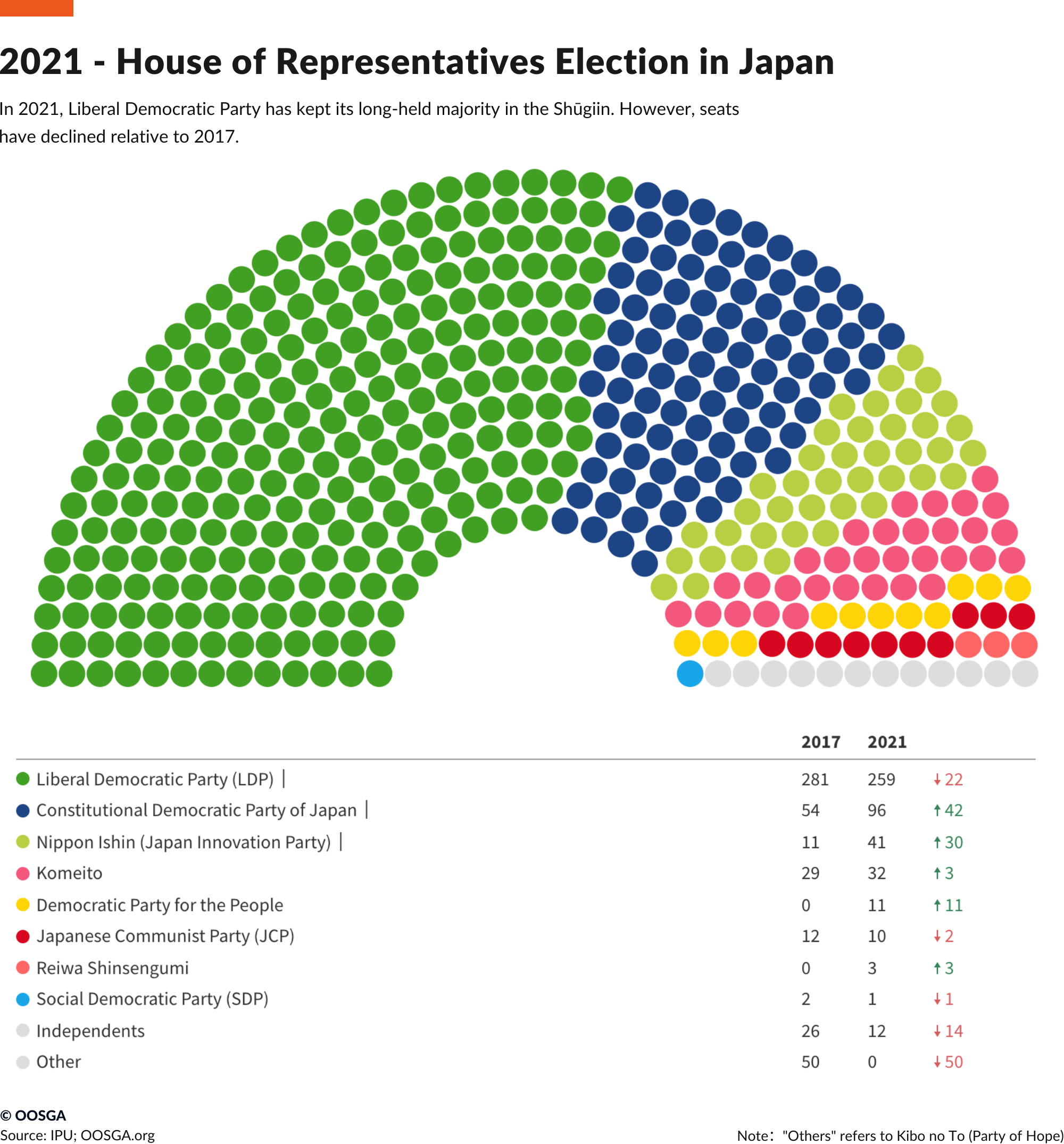

In the recent 2021 and 2022 elections, the Liberal Democratic Party and the Komeito Party, which has been allied since 1999, have continued to obtain a majority of seats in the National Assembly, and have obtained a significant gap in both the House of Representatives and the Senate. There will not be too many obstacles on the road to the constitution, especially the peaceful constitutional reform that the late Prime Minister Shinzo Abe has continued to promote (although some party members of the Japanese Liberal Democratic Party and the public are not enthusiastic about promoting the bill) .

Although the coalition government formed by the Liberal Democratic Party and the Civic Party still won a large number of parliamentary seats and popular support, a series of recent events have also added some variables to the 2025 election. After the assassination, Prime Minister Kishida held a national funeral for Prime Minister Kishida without discussing with the Diet and other political parties, which was different from the national funeral when Prime Minister Yoshida passed away in 1967 (and this behavior was also interpreted as Kishida’s attempt to win the largest party in the Liberal Democratic Party. support from the Abe faction); coupled with the relationship between the Liberal Democratic Party and the Unification Church, the public’s support for the Liberal Democratic Party has also decreased. In a recent poll, Prime Minister Kishida also showed that the opposition rate was higher than the approval rate for the first time.

Amid heightened geopolitical tensions, Japan has shifted its attention towards improving supply-chain resilience and energy security. The Kishida administration will focus on economic security by offering better protection for the country’s supply chains and encouraging the re0shoring of manufacturing, particularly in strategic industries such as microchips and green energy-related products. These efforts will intensify in the coming years. However, supply-chain diversification does not mean divestment from China, which remains a competitive manufacturing base and hosts an enormous consumer market; the Japanese government will seek to avoid straining bilateral relations.

Mr. Kishida’s proposed “new form of capitalism” initiative calls for a fairer distribution of income in favor of middle-class households and more investment in human capital. This is likely to be implemented in the form of increased minimum wages, targeted tax incentives, and subsidies to employers in order to improve in-work training and skills upgrade, rather than raising tax rates on corporate profits or increasing wealth taxes.

There is a greater willingness among employers in big companies to accommodate higher wage growth in negotiations, but small and medium-sized businesses may not be as financially able to follow suit, which will lead to more hiring of non-regular employees. We expect improvement on wage growth to be moderate and uneven, which will dilute the overall positive impact on household consumption.

The switch to renewable energy has gained urgency following Russia’s invasion of Ukraine. We expect the government to ease regulations on clean energy investment and international cooperation and to extend the feed-in tariff scheme for solar power and offshore wind farms. These measures will stimulate innovation and investment in renewable energy and carbon capture and storage technologies, as well as the use of green hydrogen and ammonia. The renewable sector’s share in the power mix will expand over the next decade, but the goal of carbon neutrality by 2050 is unlikely to be achieved without broader use of nuclear power. The government will build new-generation reactors and accelerate the restarting of existing nuclear reactors to strengthen energy self-sufficiency, despite strong local resistance.

90.62 Billion

2.1 %

-6.9 %

260.1 %

In the October 2021 elections for the House of Representatives (the two houses of Japan’s Diet with higher powers), the Liberal Democratic Party and the Komeito Party won a majority, 293 out of 465 seats. Although the Liberal Democratic Party lost 22 seats compared to the previous year, it has become one of the few political parties that still has the majority of public support after experiencing the new crown epidemic.

However, it is worth noting that, in addition to the decrease in the number of seats of the Liberal Democratic Party itself, in this election, the Japan Restoration Council, which is also right-leaning and holds similar attitudes to the Liberal Democratic Party on many issues, has a total of 11 seats in 2017. The promotion to 40 seats reflects the support of Japanese citizens for the same policy direction, but different party governance.

However, in the Senate election in 2022 (Upper Parliament), the support of the Japan Restoration Society is far below expectations. It only increased from the original 16 seats to 21 seats, and only increased by five seats like the Liberal Democratic Party. The polls conducted in November 2022 also showed that the public’s support for the Japan Restoration Society was less than 5%, compared to 43.1% for the Liberal Democratic Party.

The reason behind this is not only because the Japanese Restoration Association is often considered to represent the regional interests of the Kansai region and even Osaka, but not the interests of the whole country. After all, the Japanese Restoration Association was not only established in the Osaka area, but also Strong support from the Osaka area also made it difficult for voters in other areas to resonate with the Japan Restoration Society. The second point comes from the low stickiness of support for the Japanese Restoration Society itself, and the support of general supporters is more for individual politicians within the party than for the party itself.

Japan’s policy towards foreign investment has been gradually improving. Despite the government’s push for promotion of inward foreign investment, Japan will remain a relatively low-attractive destination due to barriers including its insular business culture, exclusive supplier networks, and low regard for shareholder value. This will result in foreign companies’ direct investment in Japan being dwarfed by direct investment abroad by Japanese companies.

In the coming years, foreign investment policies will shift towards supply-chain diversification away from China in response to increasing trade and technology conflicts with the US and heightened geopolitical risk. The Japanese government will incentivize local companies to invest in developing ASEAN countries to secure greater stability and security in their supply chains. Additionally, regulations on foreign investment in Japanese companies have been tightened and the government will continue to selectively treat foreign investors and place restrictions on both foreign influence in strategic industries and activist investors’ influence in Japanese companies. The new “Act on Promotion of Economic Security by Integrated Implementation of Economic Measures” set to take effect in 2023, will have significant implications for both domestic and foreign businesses and will target strategic industries such as semiconductors. The remaining pandemic-related travel restrictions may also deter foreign direct investment.

-

4

Although Japan’s economic prospects are not as optimistic as many advanced countries and fast-growing developing countries, Japan’s business environment is solid in terms of private enterprises, openness, labor environment, tax environment, and overall national infrastructure. competitiveness and create a very good business environment.

However, Japan lags far behind many competitors in terms of labor productivity, digitization, and Japanese business culture characteristics. As its economic growth is not as good as other competitive market factors, Japan has been far below foreign direct investment for many years. in other advanced countries.

Taking labor productivity as an example, in the past 11 years, excluding the three years after the epidemic, the labor productivity (calculated in terms of real GDP output per worker) from 2012 to 2019 was only 0.16%, far lower than most country, which is a very serious problem for an economy facing an aging and declining population.

In terms of digitalization, although in 2021, stimulated by the epidemic, the digital department (デジタル庁) proposed by Yoshihide Suga, who succeeded Shinzo Abe, completed the filing of the case at an unprecedented speed since the establishment of the new Japanese government, and finally Established in September 2021, it has organized more than 600 members (increased to more than 750 members by the end of 2020), which is about four times that of the previous digital department (IT Strategic Headhunter), and one-third of them of its members are from private enterprises. However, after more than a year now, neither the government nor the enterprise can clearly see the actions of the digital office, whether it is in terms of technological norms, digital infrastructure construction, stimulating technological investment, digital innovation and other indicators. .

In terms of the characteristics of Japanese business culture, although the so-called spirit of contract in Japan has gradually caught up with European and American countries in the past few decades, the establishment and maintenance of commercial relationships still depend very much on the relationship between people. As well as cultural integration, it is often a major factor that many small and medium-sized foreign investors feel discouraged from doing business in Japan.

-

24

Japan’s policy towards foreign investment has been gradually improving. Despite the government’s push for promotion of inward foreign investment, Japan will remain a relatively low-attractive destination due to barriers including its insular business culture, exclusive supplier networks, and low regard for shareholder value. This will result in foreign companies’ direct investment in Japan being dwarfed by direct investment abroad by Japanese companies.

In the coming years, foreign investment policies will shift towards supply-chain diversification away from China in response to increasing trade and technology conflicts with the US and heightened geopolitical risk. The Japanese government will incentivize local companies to invest in developing ASEAN countries to secure greater stability and security in their supply chains. Additionally, regulations on foreign investment in Japanese companies have been tightened and the government will continue to selectively treat foreign investors and place restrictions on both foreign influence in strategic industries and activist investors’ influence in Japanese companies. The new “Act on Promotion of Economic Security by Integrated Implementation of Economic Measures” set to take effect in 2023, will have significant implications for both domestic and foreign businesses and will target strategic industries such as semiconductors. The remaining pandemic-related travel restrictions may also deter foreign direct investment.

Despite workers in Japan are among the world’s most highly skilled, with low levels of strikes indicating positive labour relations, the growth in this particular area is not as fast as other countries.

Wage inflation in Japan will remain moderate despite rising consumer prices. Collective wage negotiations between national trade unions and business lobbies rarely result in significant wage gains, and wage demands from organized labour remain within the stated baseline range. Over the past few decades, wage inequality has improved, with equal pay for equal work well established and wage gaps between large and small companies, as well as between full-time regular workers and irregular workers, relatively small compared to other developed economies. There are strong legal protections against workplace gender inequality and age discrimination, but enforcement may still face cultural barriers, as evidenced by the modest female participation rate. The growth of gig and platform workers has become more prevalent in recent years and will continue to pose challenges for the enforcement of conventional labour standards.

In the coming years, Japan’s shrinking population and low unemployment rate will result in labour shortages, which will continue to highlight the country’s traditional resistance to immigration. The government will continue to encourage the private sector to adopt flexible labour practices, including automation and embracing older workers, in response to demographic trends and economic needs. Despite calls for wage hikes, wage inflation is expected to remain moderate due to muted economic growth and a lack of wage growth unique to Japan. The “new form of capitalism” initiative, which calls for faster wage growth, may change this if successful, but this is unlikely to materialize in 2022-23.

7.77 $

22.33 $

2800 $

-0.2393 %

Since 2016, a program of corporate tax cuts has reduced the effective corporate tax rate to less than 31% for large companies with a stated capital of over ¥100m (US$744,032). Although the consumption tax rate increased to 10% from 8% in October 2019, it remains lower compared to Europe and other developed countries and no further increases are expected.

Japan has a well-developed international tax system, supported by 68 income tax treaties and 11 tax information sharing agreements, and is aligned with the Base Erosion and Profit Shifting (BEPS) initiative. However, the current effective corporate income tax rate of 30.6% is still relatively high compared to other countries such as China (25%) and South Korea (25%). The government will likely continue to link tax policy with its economic growth strategy, including wage growth, by requiring larger companies to increase payroll costs to claim tax incentives. Taxing the digital economy will also be a priority for Japan as part of its participation in the OECD/G20 Inclusive Framework on BEPS. The introduction of a global minimum tax in 2023 for large multinational corporations will probably require the government to implement a top-up tax, which could face resistance.

Japan boasts a highly sophisticated telecommunications system, and the quality of its roads, rail, and air transport networks is high. The construction of new highways, Shinkansen high-speed railways, and airports will contribute to further improvements in the country’s infrastructure.

In the coming years, the focus of infrastructure development will shift from transport to digital and clean energy facilities, including nuclear facilities. This is in line with Japan’s goal of digitalizing its social and economic life and transitioning to environmentally friendly energy sources. Despite the country’s robust infrastructure, it remains vulnerable to natural disasters such as earthquakes, tsunamis, and volcanic eruptions. The impact of the pandemic on large infrastructure projects has been limited, and as the country recovers, construction demand will return to pre-pandemic levels, driven by urban redevelopment projects, transport network upgrades, and regional economic revival projects. The government sets priorities for national infrastructure projects under priority plans, focusing on resilience, sustainable maintenance, and digital transformation.