Connect With Authors

*Your message will be sent straight to the team/individual responsible for the article.

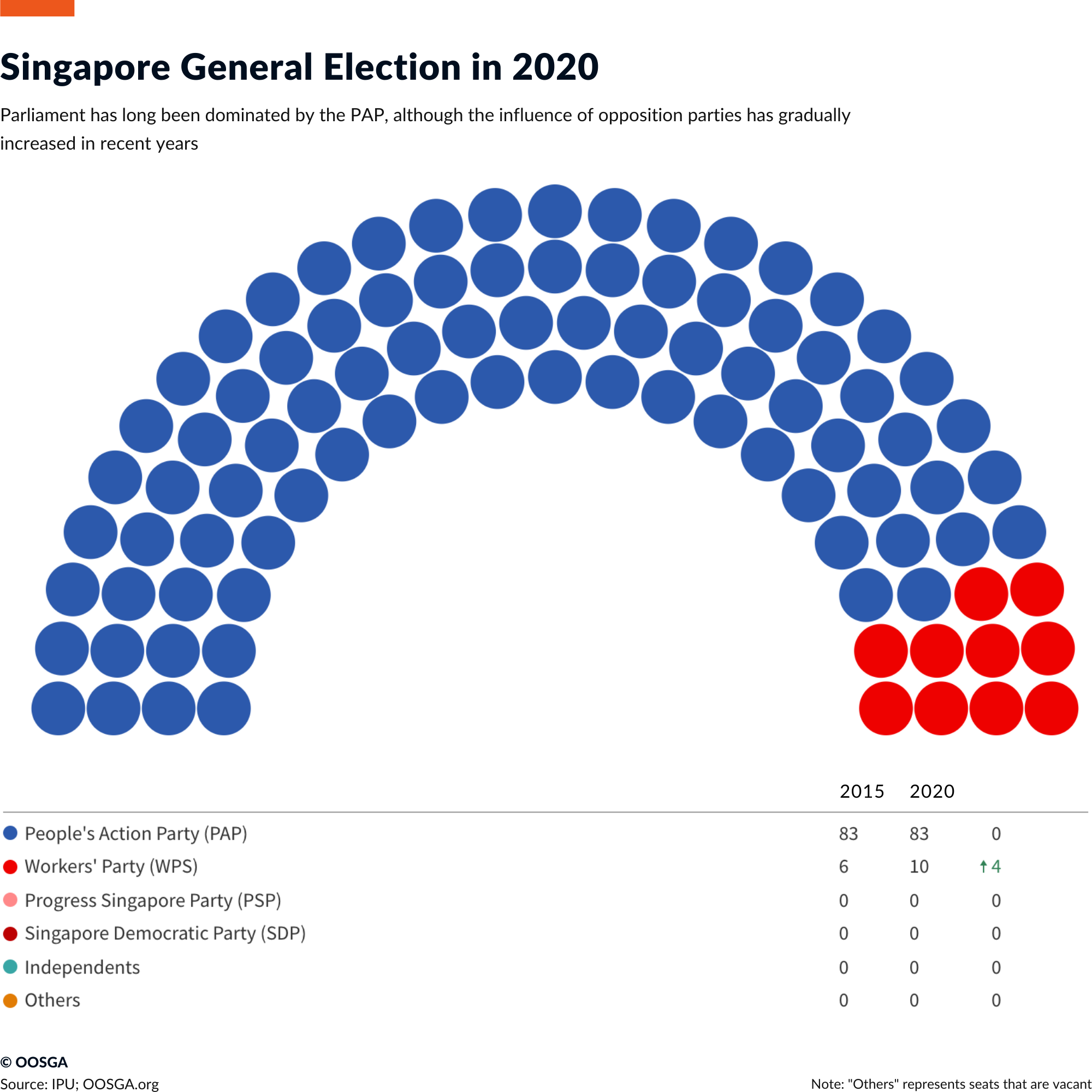

Singapore has a rich history, starting as a British colony for 144 years before gaining independence in 1965. The legal system is based on the British common law system, and the government follows the Westminster System, with three branches: the legislative branch (the president and parliament), the executive branch (the cabinet, ruling party, and prime minister), and the judiciary. For many years, Singapore has been ruled by the People’s Action Party (PAP), which has brought about numerous successes and improvements in the standard of living for citizens. However, in recent years, the PAP’s influence has declined as the proportion of non-Han nationals (Indians and Malays) in the population increases, and there has been criticism of the PAP’s paternalistic management style and its limitations on the development of opposition parties. There have also been concerns about the neutrality of legislation due to the involvement of Government Linked Companies (GLCs) in various industries.

As we cast our gaze towards the upcoming years, Singapore’s political landscape and policy evolution are set to pivot around a number of significant areas. The anticipated transition of leadership that’s likely to take place within the next half-decade is one major focus. Alongside this, we can expect the new Prime Minister to roll out the Forward Singapore Exercise, an initiative that’s generating considerable interest.

Changes in policies governing labor, immigration, and public sentiment will also play a crucial role. The government is expected to fine-tune its stance in these areas to adapt to the changing dynamics both domestically and globally.

On the international stage, Singapore is closely watching the rivalry between China and the United States, as the outcome of this power play could significantly impact its own geopolitical standing and economic prospects. Additionally, internal tensions within the ASEAN community pose their own challenges that need careful navigation. Also, the implementation of key agreements, such as the IPEF, CPTPP, and RCEP, will be an important focus. These agreements promise to redefine economic and strategic ties and have profound implications for Singapore’s position in the global economic arena. In sum, the coming years promise a complex and dynamic phase for Singapore’s political and policy development.

On the policy making aspect, Singapore government will concentrate on enhancing the quality of life for its citizens. During the budget discourse in February, the authorities proclaimed a commitment to allocate more funds towards easing the cost-of-living burdens and strengthening the social safety net for low-to-middle income residents of Singapore. There will be a moderate shift towards resource redistribution, but we we not think that Singapore will deviate from its meritocratic approach to become a comprehensive welfare state. This change could mildly impact employers and wealthier individuals by increasing their tax obligations and compulsory contributions to the Central Provident Fund, a mandatory savings plan for pension payments.

Parliamentary discussions have also looked into strategies for stabilizing the property market and enhancing housing affordability. Among the measures announced were an increase in the buyers’ stamp duty and subsidies for reselling flats under the Housing Development Board, with an aim to reduce housing expenses and waiting periods. However, the projected swift rise in property prices and rentals in 2023 might stir up public dissatisfaction and escalate the cost of employing foreigners, which in turn could negatively affect businesses’ growth strategies in Singapore.

Public concern is growing over the possibility of a substantial foreign workforce occupying jobs that could otherwise be filled by Singaporeans. In response to this, the government has repeatedly increased the minimum monthly salary requirement for employment passes, which stood at S$3,600 (US$2,650) at the beginning of 2020 and rose to S$5,000 from September 2022. Nevertheless, the government has also launched a flexible work pass aimed at attracting premier talent, particularly in the technology sector, which requires a minimFum salary of S$30,000 or equivalent significant accomplishments. Additionally, an adaptable foreign talent policy allowing strategically important or growing businesses to employ more mid-skilled S-Pass holders has been introduced to alleviate labor shortages to some extent. However, these efforts don’t imply a substantial easing of the foreign labor regulations. The high costs and uncertainties associated with these changes may deter multinational companies from hiring foreign employees for certain high-skilled positions.

90.24 Billion

- %

0.8 %

167.5 %

The People’s Action Party (PAP) won 83 out of 93 seats in Singapore’s recent general election, maintaining its strong grip on power and securing a supermajority. The Workers’ Party took the remaining 10 seats, which is the most ever held by opposition lawmakers since 1968. The PAP’s share of the popular vote also declined to 61.2%, down from nearly 70% five years prior and close to the party’s record low of 60% in 2011. The election had a high voter turnout of nearly 96%. Prime Minister Lee Hsien Loong acknowledged the decrease in popular support, attributing it to the uncertainty and pain felt by citizens during the COVID-19 crisis. The election was held during the pandemic, with 191 new cases reported on election day. Last month, Lee justified holding the election now by saying it would give the new government a fresh mandate.

Mr. Wong was appointed head of the PAP’s 4G leadership and deputy prime minister in June 2022. This has solidified his position as the next prime minister after Mr. Lee. The appointments of Chan Chun Sing and Desmond Lee to the post of assistant secretary-General indicates that the decision on the deputy prime minister has not been reached, with Desmond Lee expected to be appointed due to his younger age and Chan’s declining popularity.

The forthcoming general election, which is due by November 2025, is anticipated to occur in 2024, following the completion of the Forward Singapore Exercise. This initiative, largely spearheaded by Mr Wong, aims to address the evolving needs of Singapore’s citizens. Although Mr Lee is expected to lead the PAP into the election, the primary purpose of the vote will be to gauge Mr Wong’s popularity and legitimacy. Our analysis suggests that the PAP’s victory will be decisive enough to facilitate a smooth transition for Mr Wong to the role of prime minister early in the subsequent parliamentary term. Nonetheless, a potential pitfall exists: if the PAP’s share of the popular vote dips below 60%, this could destabilize the transition and put Mr Wong’s candidacy in jeopardy.

As for the Workers’ Party (WP), it is expected to retain its position in the chamber in the next election. Other opposition parties, such as the Progress Singapore Party and the Singapore Democratic Party, may have a slight chance of entering parliament through smaller single-member constituencies, where the PAP fields less-known candidates, or by being appointed as non-constituency members of parliament. However, the opposition is not likely to threaten the PAP’s supermajority in the near future.

-

10

Singapore continues to shine as a leading business hub, securing its position as one of the best place to do business. Its robust political stability and effectiveness put it ahead of its closest competitor, Hong Kong, in the Asia-Pacific region. The country’s high GDP per capita and expected strong growth in trade, spurred by an array of free trade, investment, and digital economy agreements, are set to drive market opportunities across Southeast Asia and beyond.

The Lion City is renowned for its welcoming policies towards foreign investment and trade, as well as its state-of-the-art technology infrastructure. The government’s proactive approach towards nurturing the development of tech start-ups and its pioneering efforts in integrating high-tech solutions into public services further enhance its position as a leading global business environment.

Singapore’s fiscal approach is also geared towards facilitating business. While the tax framework is expected to remain steady, significant changes are expected to be rolled out. In the coming years, it is expected to see a broadening of the revenue base through increased indirect taxes and a rise in the levies faced by high-income individuals and consumers of luxury goods. The later part of the period is set to witness the introduction of significant increases in carbon taxes.

However, Singapore faces challenges in a few areas. With rising office rents, the cost of investing and operating in the country is expected to increase, slightly denting the allure of its infrastructure. In addition, the labour market, already one of Singapore’s few weak spots, may face further strain. Despite an emphasis on up-skilling among workers, increased restrictions on foreign labour are likely to exacerbate existing labour shortages in many major sectors.

-

2

$

32.52 $

4570 $

2.3705 %