Connect With Authors

*Your message will be sent straight to the team/individual responsible for the article.

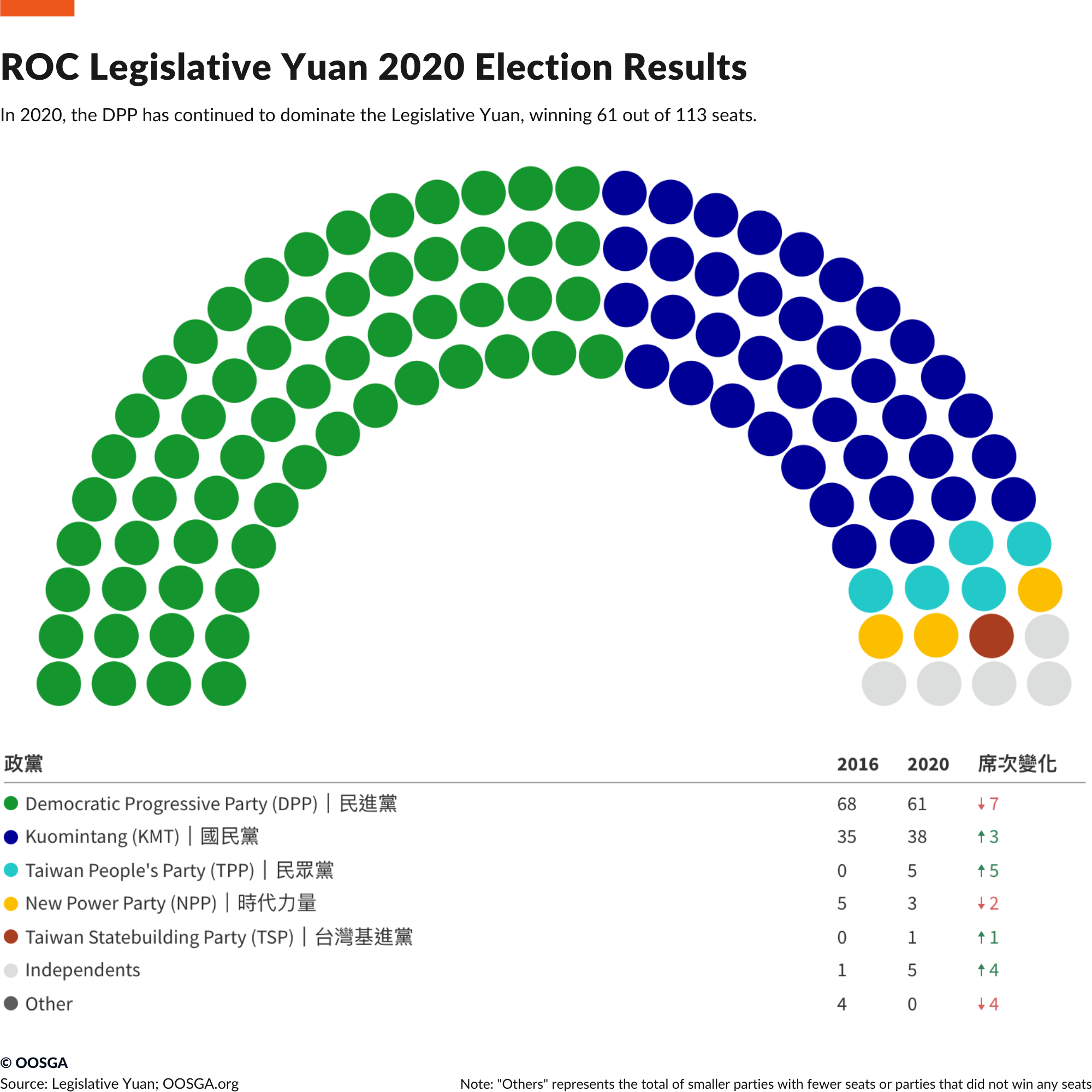

With the 2020 legislative and presidential elections over, the DPP has a majority and the re-election of President Tsai Ing-wen makes legislation relatively easy. In the election at the end of 2022, the Kuomintang won the local government election by a significant margin compared with the previous election, and after the younger People’s Party won the mayor election of Hsinchu City, it became the first time in Taiwan to win the mayor. third party.

Taiwan’s political system is a semi-presidential system, with the so-called one government and five courts (Presidential Palace, Executive Yuan, Legislative Yuan, Judicial Yuan, Examination Yuan, and Supervisory Yuan) to realize the operation and mutual supervision of the central government. The President is mainly responsible for the relationship between the state and the military. The Legislative Yuan has the power to pass or veto bills, government budgets, and even whether to start a war.

Political power in Taiwan is dispersed among the President (Tsai Ing-wen), the Premier (Chen Chien-jen), and the Legislative Yuan. The Legislative Yuan is often regarded as the National Assembly of the Republic of China, and the Executive Yuan has the obligation to submit a policy report to the Legislative Yuan and implement relevant policies; the President focuses on formulating and launching policy directions.

When the ruling party holds a majority of seats in the National Assembly, the legislative process is relatively simple, and the opposition party with a minority of seats has no specific means to block the process. Therefore, in Taiwanese politics, resorting to sit-ins or not participating in voting to express their demands often occurs. However, Taiwan’s relatively high degree of media freedom and people actively participating in politics have enabled the ruling party to be supervised by forces outside the parliament in the legislative process.

For example, in 2006, the Kuomintang and People First Party members proposed the removal of President Chen Shui-bian. After not more than two-thirds of the legislators agreed, politicians organized the people to take to the streets and launched the Red Shirt Movement, which led to the resignation of the then president. The same incident also happened with the service trade agreement between mainland China and the cross-strait under President Ma. In addition, after the referendum law was passed, the Kuomintang organized referendums on same-sex marriage, energy policy, and the Raizhu incident, but they failed in the final election.

As global growth subsides in 2023, key policy priorities will focus on revitalizing household spending, countering the softening demand for Taiwanese goods and the impact of stringent credit conditions on investment, employment, and incomes. Authorities are predicted to employ multiple rounds of consumption stimulus to achieve this goal. The anticipated April 2023 disbursement, offering one-off subsidies of NT$6,000 (US$193) per household, may however be diverted towards savings by households, in response to dwindling consumer confidence and escalating economic uncertainties.

In her final full calendar year in office, Ms Tsai and the DPP will tackle the long-term objectives outlined in her policy agenda. Addressing intergenerational equality, extending social housing, and augmenting childcare and eldercare support will take precedence. While the government plans to implement another minimum wage increase in September 2023, the increment is projected to be relatively modest in comparison to previous years. The expected economic slowdown may constrain substantial wage augmentation in the private sector. Despite this, real average wage levels, expected to stagnate in 2023, are predicted to bounce back in 2024 as growth prospects rally. However, officials may grapple with surging living costs, the looming threat of industrial competition, and talent-poaching from China.

Efforts to upgrade the nation’s infrastructure and stimulate investment will be driven by the Forward-looking Infrastructure Development Programme and the “5+2” Industrial Innovation Programme over the next five years. Emphasis will be placed on developing digital infrastructure, with the government fostering “six core strategic industries”, including renewable energy and next-generation information technology, to attract future foreign investment.

In 2021, Taiwan extended economic incentives, such as subsidized loans and expedited land acquisition, to domestic firms affected by the China-US discord to encourage re-shoring production from China. These measures aim to leverage Taiwanese companies’ efforts to decrease their supply-chain dependency on China. Amid the worsening regional geopolitical tensions, investment repatriation is expected to continue through 2023-27.

In the diplomatic relations between Southeast Asia and India, the signature policy of the Tsai administration is the so-called “New Southbound Policy”, focusing on the ten ASEAN countries, six South Asian countries, and New Zealand and Australia. Under the impact of China’s economic slowdown, domestic active promotion of import substitution, trade obstruction to Taiwan, and US trade sanctions against China, this policy has just dispersed the dependence of many companies on the Chinese mainland market, which is why they are different For the Lee Teng-hui and Chen Shui-bian administrations, this southbound policy has created clear political achievements.

However, whether Taiwan can join the CPTPP will also affect its performance in the “new southbound market”; if it succeeds, Taiwan’s industries other than ICT will also gain more growth momentum. With the growth of national consumption power in the ASEAN countries and the Indian market, and the continuous improvement of industrial productivity, Taiwan’s economic development potential will be further stimulated.

101.31 Billion

- %

-1.7 %

29.7 %

Taiwan’s President Tsai Ing-wen has been re-elected for a second term after receiving 57% of the vote, a record 8.2 million votes, in an election dominated by Taiwan’s relationship with China. Tsai opposes closer ties with China, while her opponent, Han Kuo-yu, suggested that closer ties would bring economic benefits. In her victory speech, Tsai told China to abandon its threat to take back Taiwan by force and called for peace between the two nations.

The US hailed President Tsai’s victory as a demonstration of Taiwan’s “robust democratic system” and expressed hope that Taiwan will continue to be a shining example for other countries striving for democracy and prosperity. Tsai’s re-election, which was a landslide mandate, was a major snub to Beijing. The election results reflect the growing fear among Taiwanese voters of being overtaken by mainland China, particularly in light of Beijing’s handling of pro-democracy protests in Hong Kong. President Tsai insists that Taiwan’s future should be decided by its 23 million people.

In the November 2022 elections, the Kuomintang (KMT) party had a sweeping victory but regional influence may not be telling for the presidential and legislative elections in January 2024.

Currently, it’s anticipated that Lai Ching-te, the Vice-President and recently appointed DPP chair, will be the representative for the DPP. Ko Wen-je, the former Taipei mayor, will be stepping up for his freshly formed Taiwan People’s Party. Meanwhile, Hou Yu-ih, the sitting mayor of New Taipei, will carry the banner for the KMT. The poll data, as it stands, doesn’t clearly point to a leading candidate. However, it’s possibly fair to suggest that the KMT’s representative is gradually losing traction with a significant portion of Taiwanese voters.

-

20

Taiwan’s business environment is projected to improve significantly over the next five years. This progress is largely due to enhancements in areas such as technological readiness, financing, policies towards foreign trade and exchange controls, and infrastructure. However, it’s important to note that progress in these areas may be somewhat constrained due to the unchanged macroeconomic environment and taxes, alongside a decline in labor market and political stability. As Taiwan strives to lessen its trade reliance on China, it faces challenges due to strong Cross-Strait supply-chain linkages and China’s attempts to isolate Taiwan.

Taiwan shines particularly in the area of technological readiness. This is a testament to the island’s advanced manufacturing capabilities and high level of innovation within its technology sector. The global semiconductor shortage has further demonstrated Taiwan’s industrial strength, leading to a surge in its industrial production and exports. As an economy dependent on trade, Taiwan has also demonstrated strong policies and controls relating to foreign trade and exchange. This is evidenced by its low public debt levels, a stable exchange rate, and minimal barriers such as tariffs, rigorous custom checks, and currency restrictions.

However, Taiwan faces challenges in expanding market opportunities due to the small size of its domestic consumer market and fragile retail performance. This situation is exacerbated by Taiwan’s exclusion from regional trade agreements at a time when its regional competitors are pushing for tighter trade integration. Despite these challenges, foreign investors can expect to maintain good access to local financing, thanks in part to significant capital inflows and stable economic expectations. In terms of the labor market, while poor language skills present a challenge, weak wage growth helps to maintain Taiwan’s labor cost competitiveness.

-

13

5.3 $

11.94 $

1910 $

1.25 %