From Turbulence to Stability: Australia’s Economic Resurgence

Australia’s economy, primarily driven by its resource-based exports and a well-developed services sector, is expected to experience a deceleration in GDP growth in 2023. This can be attributed to the tightening of monetary policy, which will adversely affect private consumption and investment. While private investment in the housing and construction sectors will face challenges, public investment in green energy initiatives and transportation infrastructure will remain resilient. The country’s export sector is poised to benefit from China’s economic reopening, as it gradually eases trade penalties on Australian goods, such as coal and agricultural commodities.

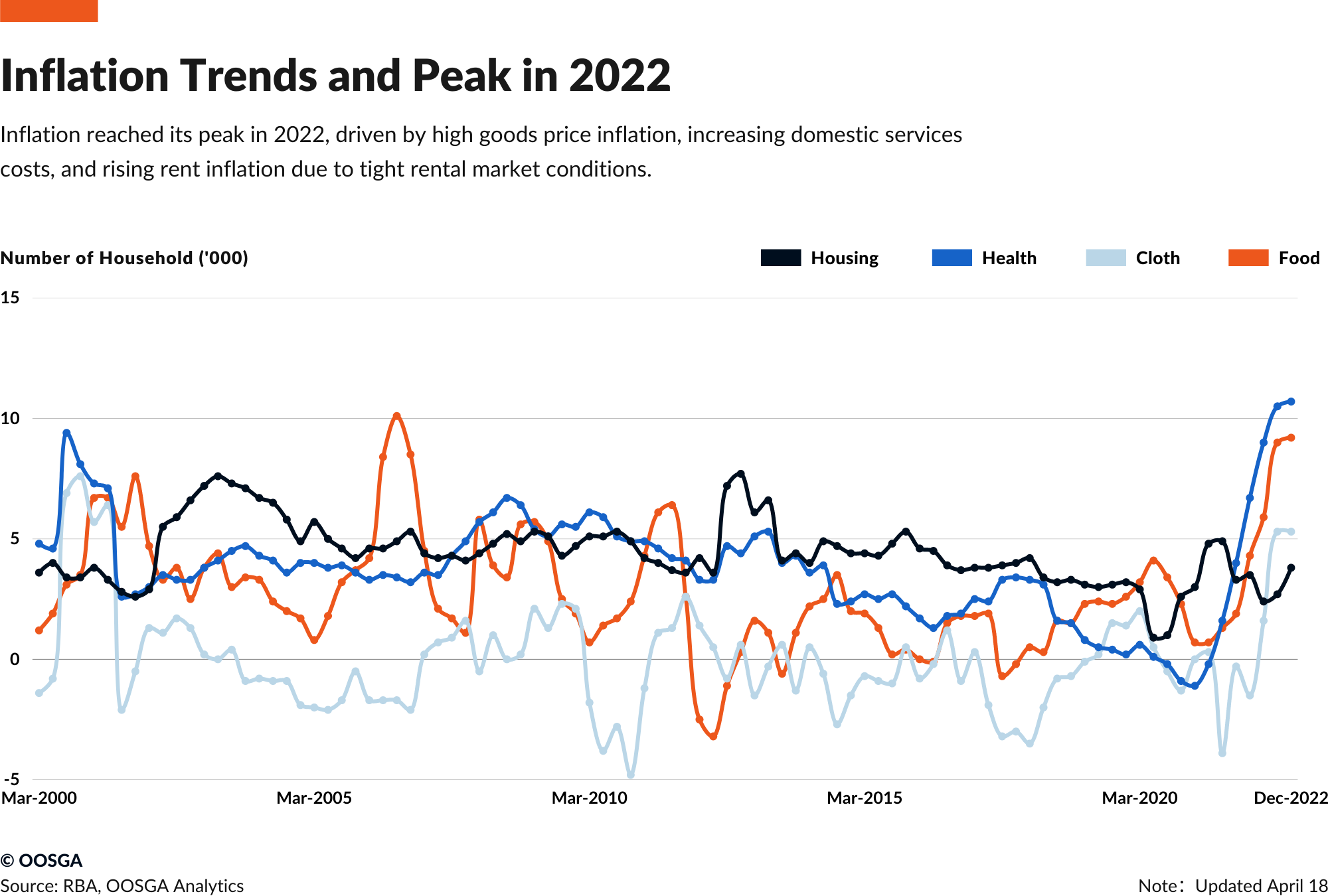

In the medium term, Australia’s economic growth is projected to go down to an average of 2% in the next five years, primarily due to a slowdown in the mining sector. Australia is currently also struggling with the inflation. The situation will likely ease from a 32-year high of 7.8% by the end of 2022, the retail sector however was impacted the most.

According to the latest estimates from the RBA, grocery prices (excluding fruit and vegetables) rose 2.2% in the December quarter, with an 11% annual growth rate, the highest since 1983. Most food items experienced price increases, particularly dairy products, due to higher wholesale costs. Liaison indicates grocery prices will continue to rise in the near term, albeit at a slower pace.

The changes in housing prices are also critical, as it historically play a crucial role in shaping consumer sentiment in the country. In December, the Reserve Bank of Australia (the central bank) increased interest rates for the fifth consecutive month. Elevated rates are suppressing the residential property market, which experienced a sharp price increase due to robust demand amid the pandemic. This will impact consumer sentiment and sales in the household goods sector in the short term.

However, the situation is reversing, Australian consumer confidence demonstrates signs of recovery, supported by the Reserve Bank of Australia’s decision to pause interest rate increases. A weekly survey by ANZ Bank and Roy Morgan reported a third consecutive weekly increase, while the Westpac Melbourne Institute showed a 9.4% rise in its consumer sentiment index in April. Though overall confidence remains weak due to the impact of 10 consecutive interest rate hikes, household inflation expectations have dropped, and various data confirm that Australia has passed peak annual inflation.

Australia’s Affluent Evolution: Rising Incomes and Opportunities

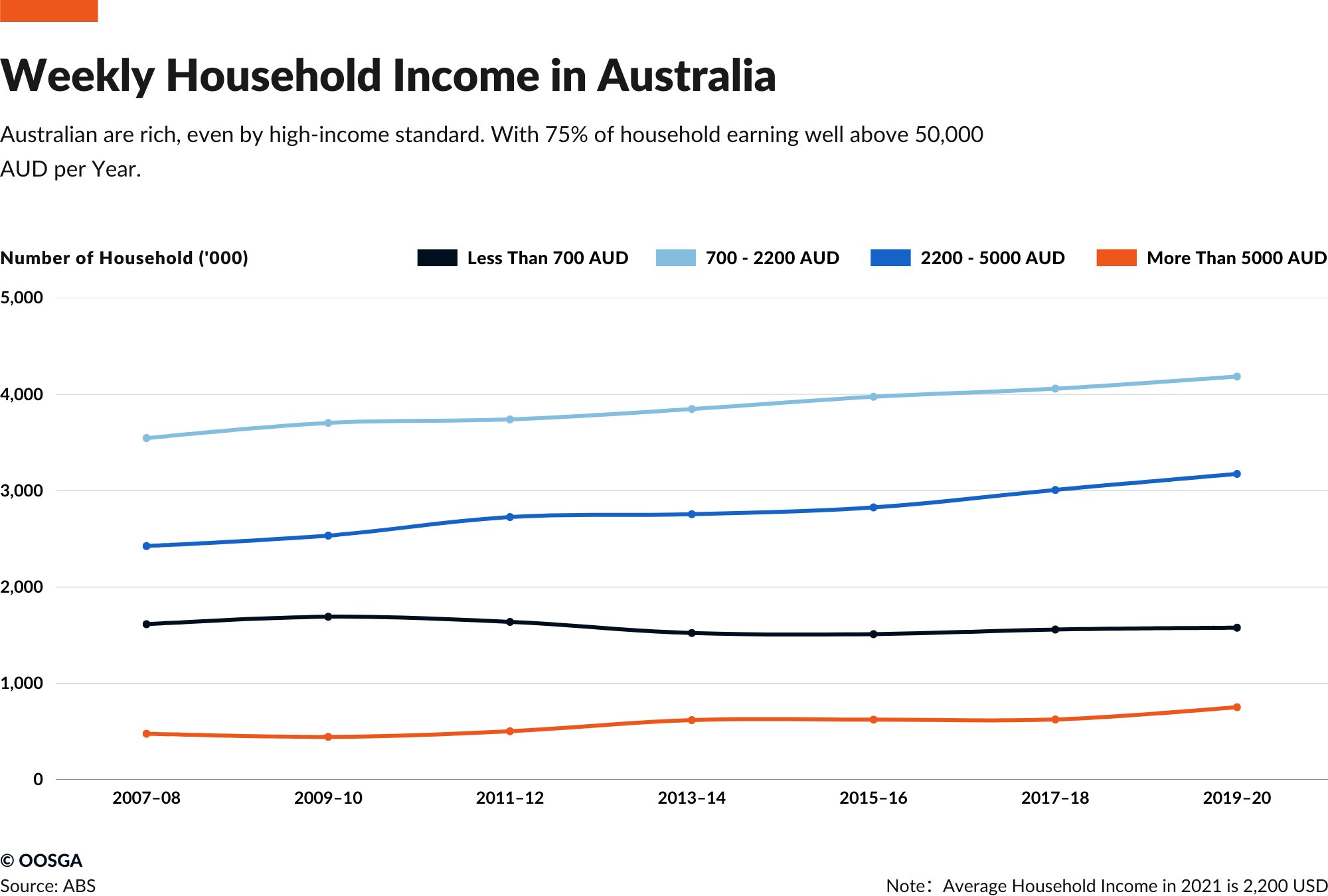

Boasting a wealthy consumer base, over 75% of Australian households earn well above 50,000 AUD per year in 2021, according to the latest estimate from the ABS. In the same report, we also found that the structure of different consumption class is slowly changing. While the number of households that are living below 700 AUD income per week has 2.2% decline over the last decade, the number of households that are earning above 5000 AUD is growing fast, expanding at a rate of 57% in the same period.

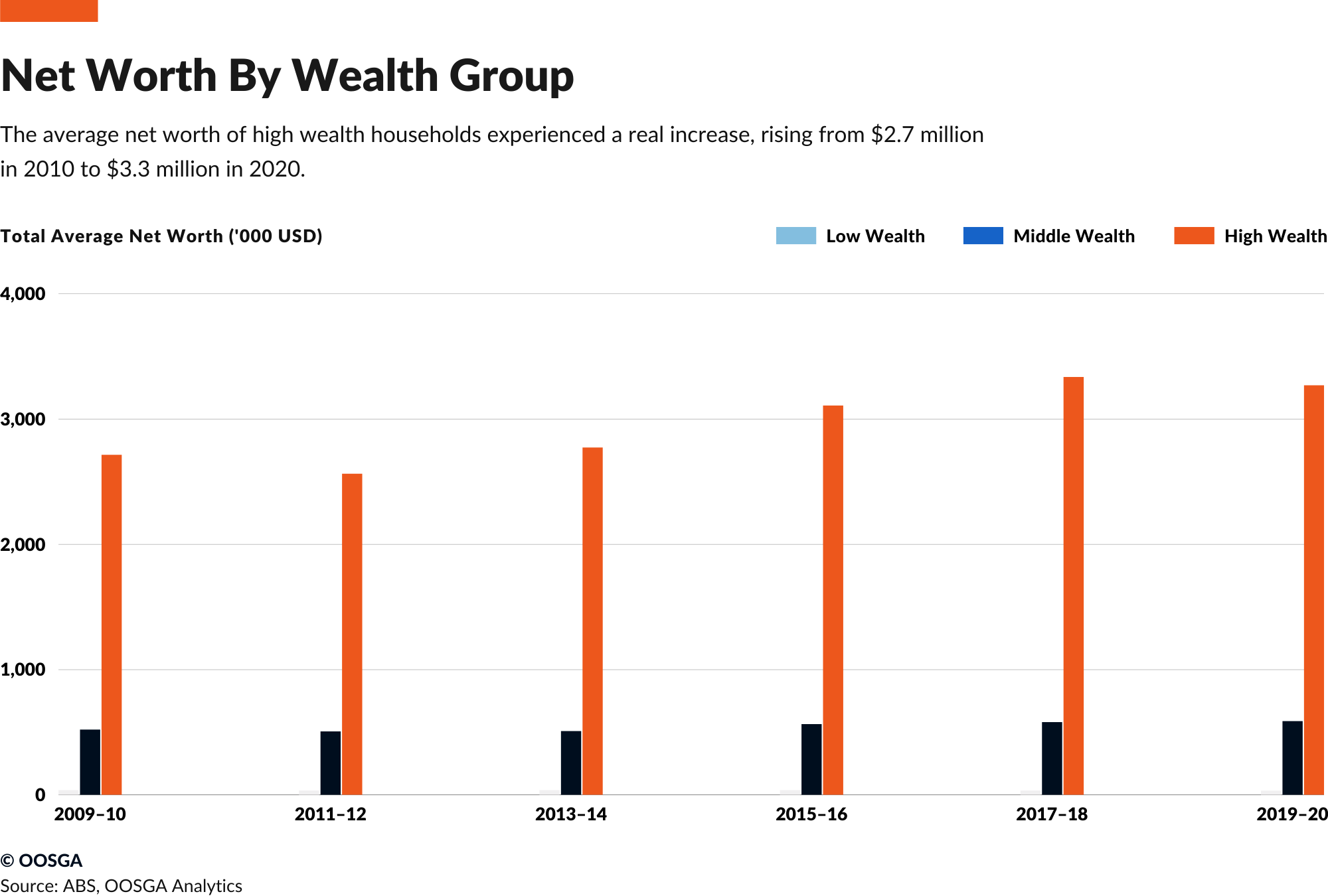

Income alone doesn’t provide a complete picture. With the significant surge in housing market prices, high-wealth households have seen an average increase of $683,000 in their property values over the past 15 years. This, in turn, has contributed to the growth in wealth for these affluent families, raising their average net worth from 2.7 million AUD to 3.3 million AUD over the last decade.

The combination of increasing income and net worth for wealthy households in Australia, along with the trend of affluent families migrating to the country, offers substantial opportunities. However, the premium and luxury fashion market has traditionally been heavily reliant on tourists, especially those from China. With the expansion of the luxury sector in China, Chinese tourists are anticipated to spend less on luxury goods in international markets compared to pre-pandemic levels. Consequently, luxury brands in Australia or those considering entering the market will need to shift their focus towards serving the needs of prosperous Australians.

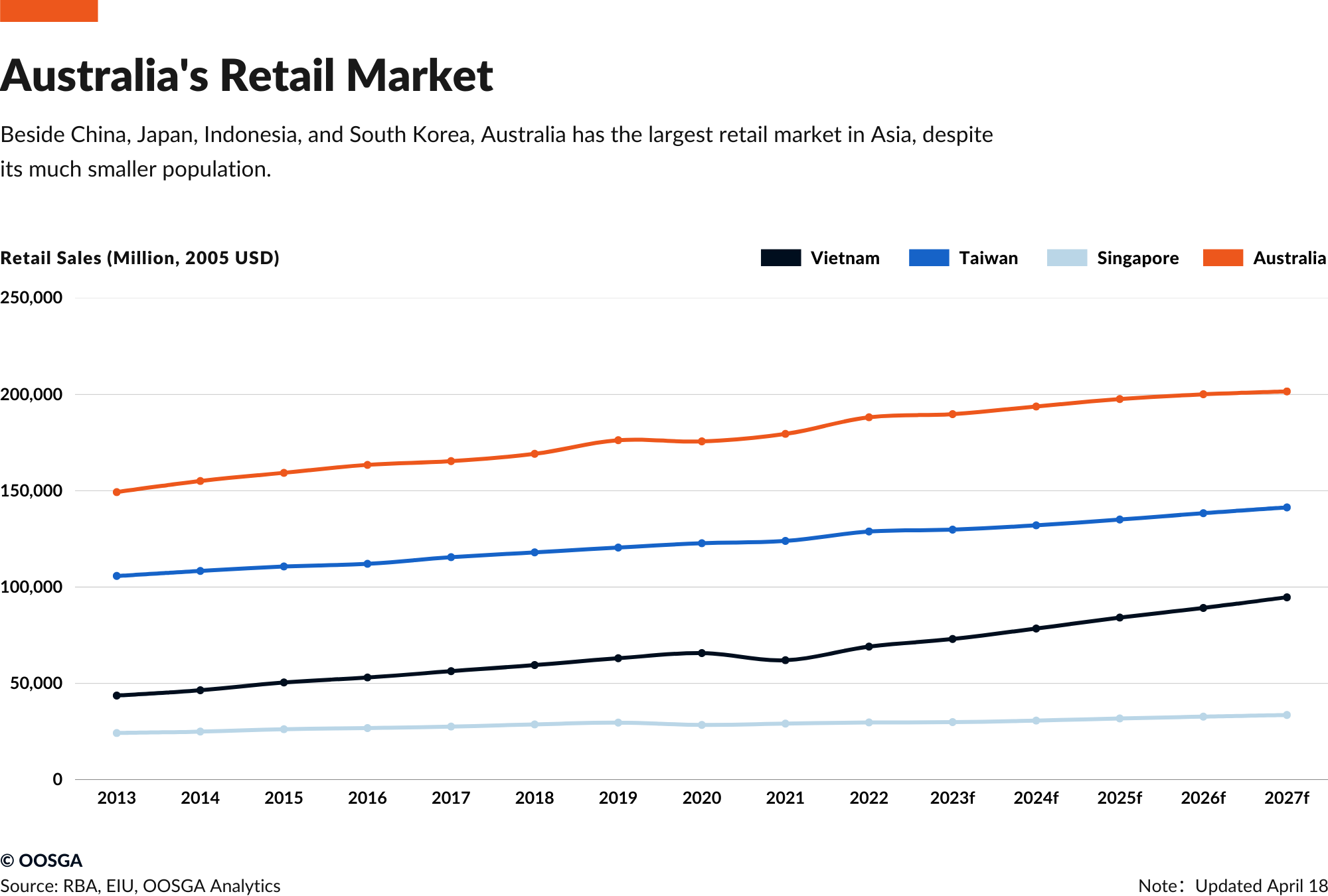

Beside the super rich, Australia itself is a substantial market that global players can’t look away. In our analysis, we found Australia has the sixth largest retail market in Asia and is currently still expanding at a rate higher than many other developed countries.

What does Australian spend on?

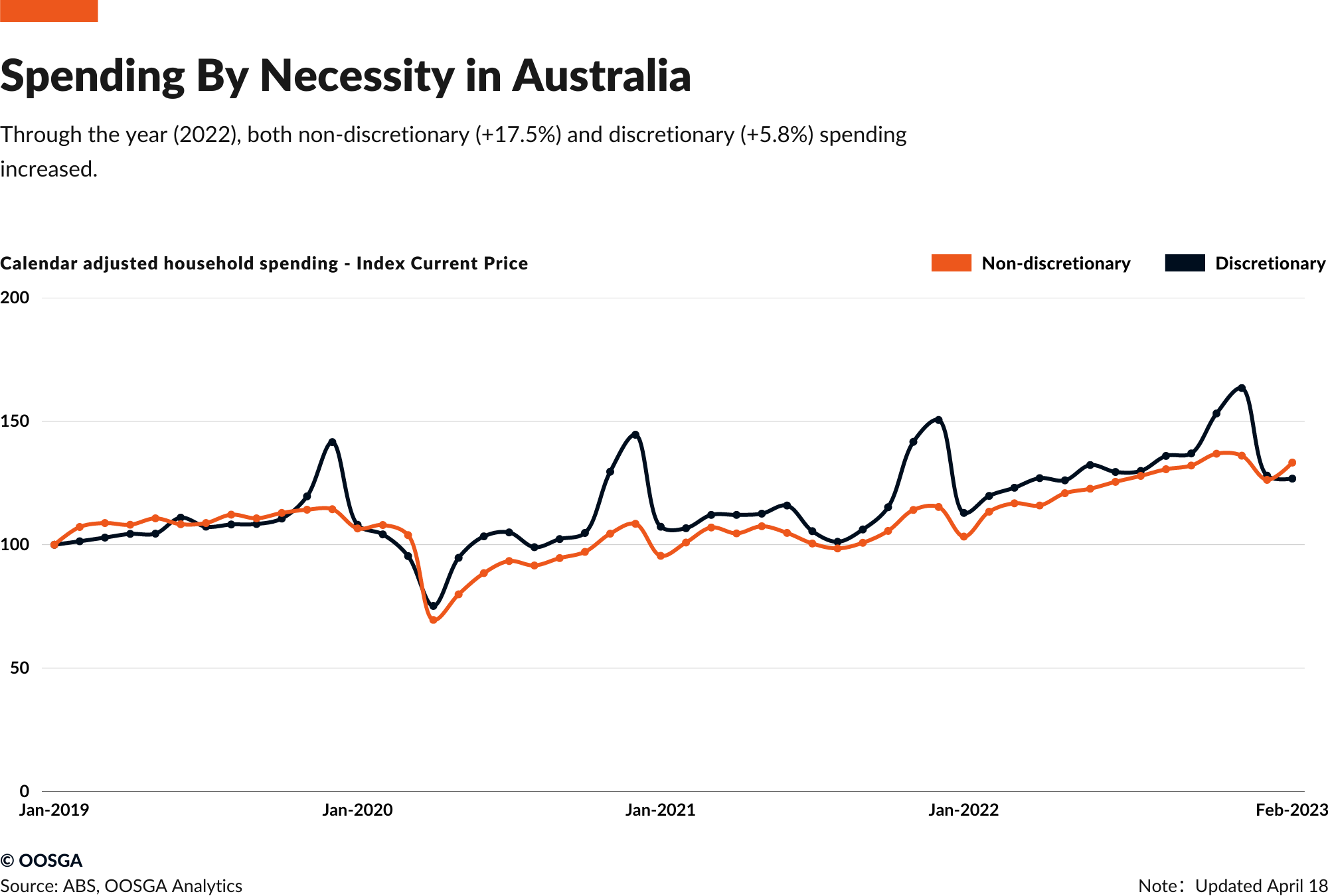

Over the course of the year, there was a notable increase in household spending across both discretionary and non-discretionary categories. Discretionary spending experienced a 5.8% rise, primarily fueled by expenditures in recreation and culture as well as clothing and footwear. Meanwhile, non-discretionary spending saw an even more substantial growth of 17.5%, with the main drivers being spending on transport services and catering services.

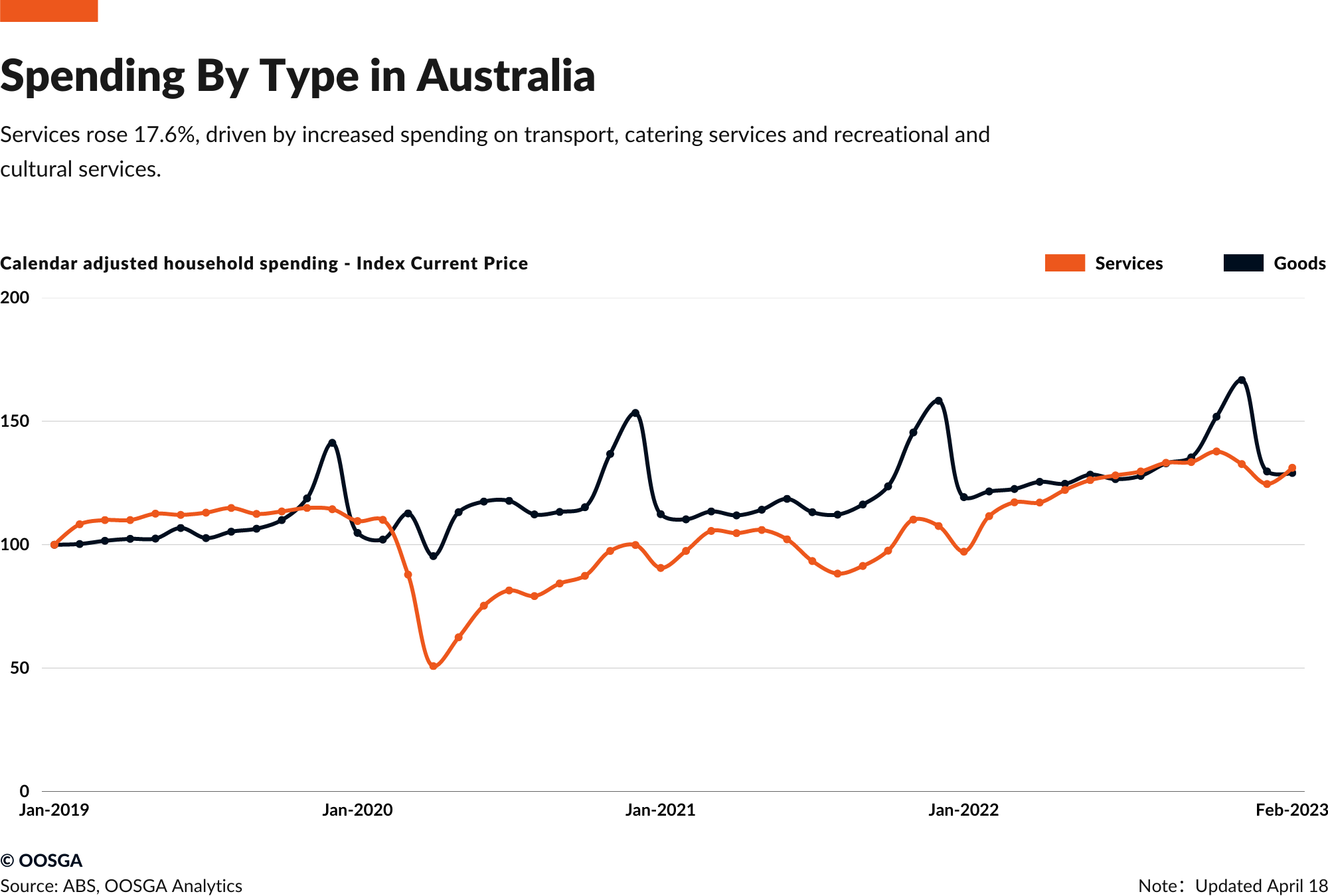

Throughout the year, household spending experienced growth in both services and goods categories. There was a 17.6% increase in spending on services, primarily fueled by heightened expenditures on transport, catering services, and recreational and cultural services. Concurrently, spending on goods also rose by 6.1%, driven by higher purchases of food, goods for recreation and culture, as well as clothing and footwear.

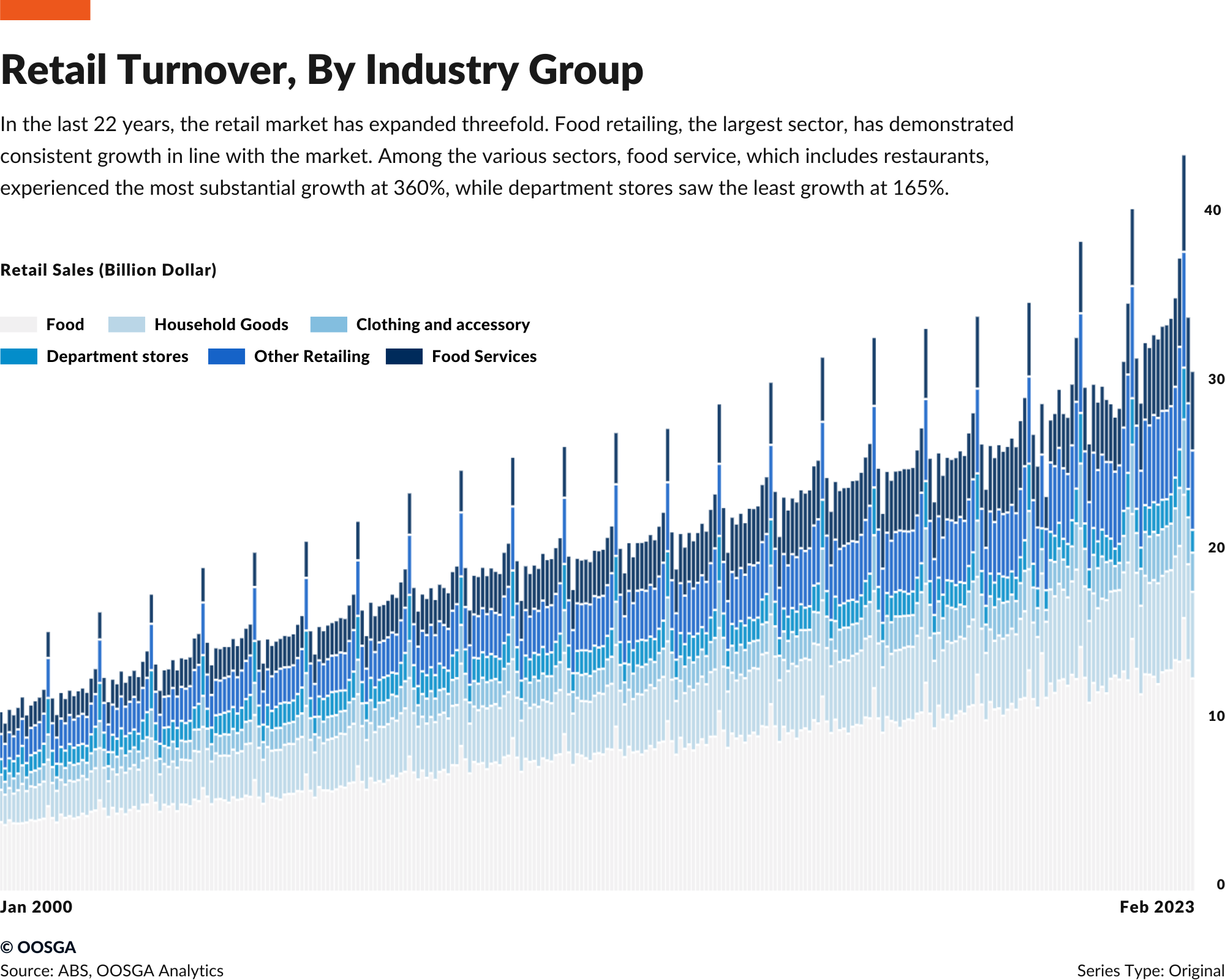

From a more macro’s perspective, In the last 22 years, the retail market has expanded threefold. Food retailing, the largest sector, has demonstrated consistent growth in line with the market. Among the various sectors, food service, which includes restaurants, experienced the most substantial growth at 360%, while department stores saw the least growth at 165%.

Food

In the processed food segment, the dominant players are foreign-owned companies such as Nestlé (Switzerland), Kraft (US), and Campbell’s (US). However, these producers face increased competition as retailers expand private-label offerings to offset margin pressures. The processed food industry may see growth in 2023-27, with cost-conscious households opting for pre-packaged and ready-to-eat food over expensive fresh produce. Woolworths anticipates a gradual rise in the share of fresh organic produce in its total sales, reflecting growing consumer popularity. Other key players in the fresh grocery market include local companies Coles and IGA, and Aldi. On the supply side, high fertilizer prices, extreme weather events, and subsequent supply-chain disruptions pose challenges for the agriculture sector.

In the beverage segment, demand for alcoholic drinks in the near term is predicted to resurface through off-trade channels such as supermarkets, hypermarkets, and online stores. The removal of all pandemic-related restrictions will stimulate domestic and international tourism, boosting sales across foodservice and off-trade channels. In August 2022, the Australian Tax Office increased the excise on beer by 4%, the largest hike in over 30 years, impacting local brewers. Australia, the world’s fifth-largest wine exporter, is experiencing reduced domestic alcohol consumption due to rising health concerns and stricter enforcement of drunk-driving laws.

Food Service

The pandemic-induced shift towards at-home consumption is expected to continue even as in-premises dining services recover, presenting opportunities for food-delivery and cloud kitchen companies. UberEats holds an 80% share of Australia’s food-delivery market, but high food and fuel prices and a labor crisis will create profitability pressures, particularly for small establishments. Retail turnovers at cafes, restaurants, and takeaway services in 2022 have long surpassed 2019 levels. As inflation squeezes household budgets, a larger proportion of spending at restaurants and cafes will come from tourists in 2023-24.

Consumer Electronics

Growth in sales of mobile devices like tablets and smartphones is predicted to slow in the near term due to high market penetration and challenges in the global electronic supply chain. Retail sales of electronic goods experienced an uptick during the festive sales in November-December 2022, but they are expected to remain subdued in 2023-24 as households delay big-ticket purchases until inflation cools off. Apple (US) and Samsung (South Korea) dominate the smartphone market with a combined 80% market share. Chinese brands such as Oppo and Huawei hold smaller shares, and most electronics sales will continue to occur online, with Kogan.com, Apple, and JB holding the largest shares in the online retail market for consumer electronics.

Apparel and Footwear

Consumer expenditure on apparel and footwear increased in 2022 as consumers resumed activities like travel, dining out, and leisure. However, a shift in spending from goods to services and the impact of inflation on real income are likely to slow volume growth in the near term. The premium and luxury fashion market has traditionally relied on tourists, particularly from China. As the luxury sector expands in China, Chinese tourists are expected to spend less on luxury goods in international markets, prompting luxury brands in Australia to focus more on catering to affluent Australians.

Household Goods

Residential property prices in Australia soared during the pandemic, but rising interest rates have increased mortgages and slowed home sales even as prices decline. Following heightened spending during the pandemic, a shift in spending towards services and a slowdown in the property market will result in sluggish sales of household goods and furniture. Electrolux (Sweden) controls almost half of the Australian white-goods market, followed by LG (South Korea) and Whirlpool (US).

State-wise data

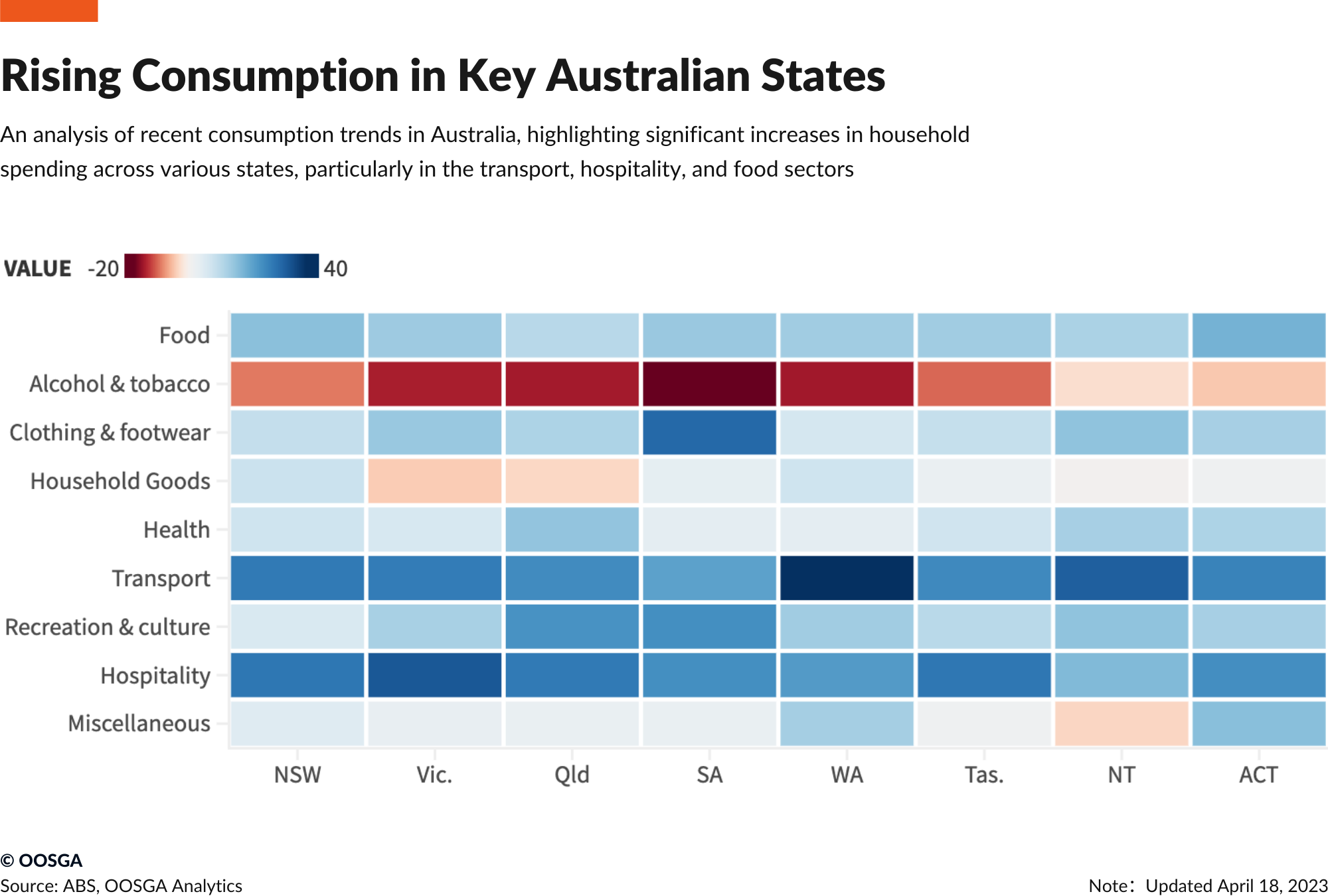

In the past year, Australia has experienced a notable surge in household spending across all states and territories. The Australian Capital Territory (ACT), Western Australia, and Queensland have recorded the most robust increases with 15.0%, 13.6%, and 12.6% respectively. This growth in spending demonstrates a positive trend in consumer confidence and may signal further economic progress in the coming months.

A closer look at the spending categories reveals that transport, hotels, cafes, and restaurants, and food were the primary drivers of this growth. In the ACT, spending in the transport sector increased by a remarkable 24.2%, while hotels, cafes, and restaurants saw a 22.5% uptick, followed by a 17.0% increase in food expenditure. Similarly, Western Australia witnessed a staggering 36.0% rise in transport spending, a 20.6% increase in hotels, cafes, and restaurants, and a 12.6% growth in food consumption. Meanwhile, Queensland observed a 25.5% increase in spending on hotels, cafes, and restaurants, a 22.9% rise in transport, and a significant 21.9% jump in the recreation and culture sector. These figures highlight the growing consumer interest in leisure, hospitality, and travel across the country.