Connect With Authors

*Your message will be sent straight to the team/individual responsible for the article.

Since India’s independence in 1947 and the split of East and West Pakistan, which led to the formation of predominantly Muslim Bangladesh and Hindu-majority India, tensions have continued to simmer between the two nations. This conflict resulted in three wars until a ceasefire was finally reached in 2003. However, the India-Pakistan Line of Control remains a source of constant conflict and occasional exchanges of fire.

Over the past 75 years, India has transformed from a poor economy with a per capita GDP of less than $50 a year to a low-and-middle-income economy with a per capita GDP of approximately $2,500 (2022). India now boasts the world’s largest population, and its economy, measured by GDP, has surpassed that of the UK, making it the fifth largest in the world.

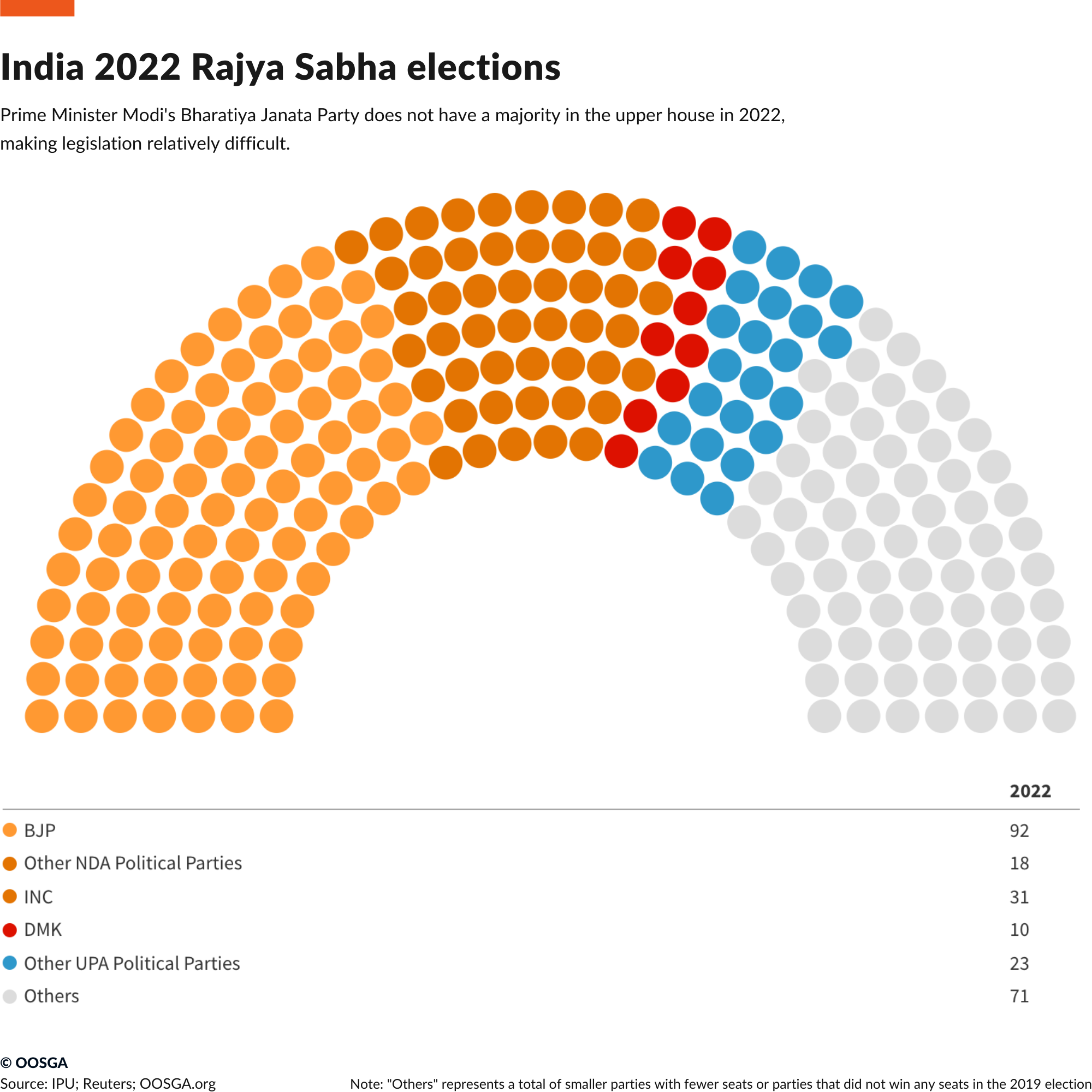

India’s political system is built on the British Westminster model, featuring an upper house, the Rajya Sabha, and a more powerful lower house, the Lok Sabha. The Indian presidency is a five-year term elected position, while the royal family remains hereditary. As of 2022, the ruling Bharatiya Janata Party (BJP) and its coalition, the NDA, hold the majority in the Lok Sabha, with the opposition maintaining a majority in the Rajya Sabha.

Since Prime Minister Modi took office in 2014, the Indian government has implemented numerous policy reforms, such as the reassessment of 150 labor laws and the official passing of relevant bills in 2020. These reforms aim to improve the ease of doing business and stimulate growth in industry and manufacturing.

Since India’s independence in 1947 and the split of East and West Pakistan, which led to the formation of predominantly Muslim Bangladesh and Hindu-majority India, tensions have continued to simmer between the two nations. This conflict resulted in three wars until a ceasefire was finally reached in 2003. However, the India-Pakistan Line of Control remains a source of constant conflict and occasional exchanges of fire.

Over the past 75 years, India has transformed from a poor economy with a per capita GDP of less than $50 a year to a low-and-middle-income economy with a per capita GDP of approximately $2,500 (2022). India now boasts the world’s largest population, and its economy, measured by GDP, has surpassed that of the UK, making it the fifth largest in the world.

India’s political system is built on the British Westminster model, featuring an upper house, the Rajya Sabha, and a more powerful lower house, the Lok Sabha. The Indian presidency is a five-year term elected position, while the royal family remains hereditary. As of 2022, the ruling Bharatiya Janata Party (BJP) and its coalition, the NDA, hold the majority in the Lok Sabha, with the opposition maintaining a majority in the Rajya Sabha.

Since Prime Minister Modi took office in 2014, the Indian government has implemented numerous policy reforms, such as the reassessment of 150 labor laws and the official passing of relevant bills in 2020. These reforms aim to improve the ease of doing business and stimulate growth in industry and manufacturing.

Currently, there are three main policy developments in India. First, the government aims to upgrade business and trade infrastructure, including ports, railways, roads, and logistics centers. Second, it seeks to reform land policies, an effort ongoing since the adoption of the New Economic Policy in 1991. However, this reform faces resistance from citizens and is not expected to make significant progress after losing the legislative majority in the Rajya Sabha. Lastly, the government is focusing on increasing market power and stimulating business through various mechanisms.

-66.96 Billion

-2 %

-9.2 %

81 %

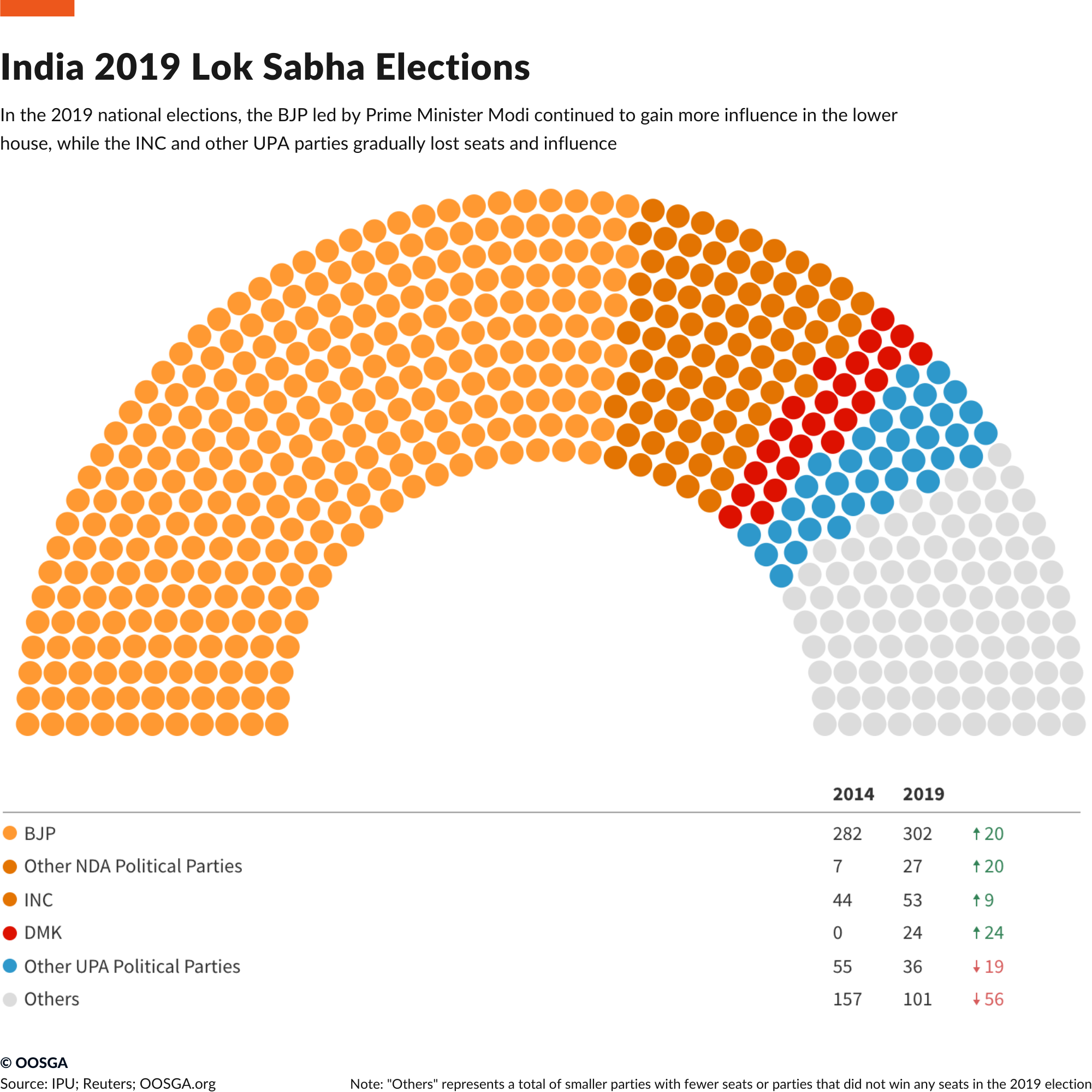

In the 2019 Indian election, Narendra Modi and the BJP achieved a landslide victory, securing 303 seats in the Lok Sabha, the lower house of the Indian parliament. This surpassed their 2014 win of 282 seats. While the opposition party, the Indian National Congress, and its allies mounted a stronger challenge, they only managed to obtain 54 seats. The 2019 election saw a record number of female voters and candidates, with female voter turnout equalling male voter turnout for the first time in Indian history. Despite this progress, men continue to dominate national politics, as only 723 of the 8,000 candidates were female, accounting for less than one in ten. The seven national parties fielded the same number of candidates in 2019 as they did in 2014.

Looking ahead to the next general election in India, scheduled for May 2024, the BJP is projected to maintain its stronghold due to the incumbency advantage, successful implementation of reforms, and a fragmented opposition. Prime Minister Narendra Modi is expected to be the BJP’s candidate once again, although he may pass the leadership mantle to a party ally because of his advancing age. Rahul Gandhi, the de facto leader of the Congress party, is likely to be his main electoral rival, but he remains unpopular among voters.

Regional parties are not anticipated to pose a significant challenge to the BJP at the national level. Furthermore, the BJP is expected to consolidate its power in the Rajya Sabha before the 2024 election by winning seats in the 2023 biennial elections in West Bengal and Tripura. However, this is unlikely to result in an absolute majority for the party in the upper house. Recent opinion polls also suggested a rougher path for the leading party.

The Indian government aims to strengthen its “Make in India” campaign and the “self-reliant India” initiative in the next five years to boost local manufacturing. With nearly INR 2 trillion (US$25 billion) allocated to the production-linked incentives (PLI) scheme by 2025, 14 sectors, including medical devices, consumer electronics, and white goods, are targeted. In 2022, the PLI outreach was expanded to solar modules and semiconductors. These initiatives, alongside the temporary corporate tax rate cut for new manufacturing companies introduced in 2019, are expected to have a more visible impact on the economy after 3-5 years. However, challenges in the business environment, such as land acquisition and competition for FDI from South-east Asia, will persist.

The e-commerce market is anticipated to attract substantial FDI over the next decade, with US and European firms seeking to establish a presence. The Reliance Jio platform, boasting over 430 million subscribers, offers an attractive entry point for foreign firms into the Indian online technology market. Although Chinese investors used to be active participants in Indian internet start-ups, structural tensions between China and India have led to a significant reduction in their presence. Stricter investment requirements from bordering countries have slowed Chinese capital inflow, but not stopped it altogether. Long-standing tensions at the disputed border with China will likely continue, reinforcing India’s nationalistic posture and banning companies from border countries from bidding on public contracts.

-

13

India’s business environment is expected to show improvement over the next decade, primarily due to factors such as a stable political environment, increased foreign investment, better tax coverage, and reduced trade controls. The huge potential presented by India’s large population and growing economy also contribute to an increase in market attractiveness and opportunities in the coming decades.

Over the next decade, we are expecting a substantial increase in its labor market, foreign trade, and exchange control, given the current administration working towards becoming a manufacturing hub. The return of the Bharatiya Janata Party (BJP) government, which is expected to win the 2024 national elections, is expected to support India’s growth as an export manufacturing hub through the BJP’s Production Linked Incentives program. Although India does not rely on regional trade blocs, it will work to strengthen bilateral trade relationships with countries such as Australia, the UK, and the US. The labor environment will also improve as the BJP government is expected to adopt new labor reforms, which were delayed due to the pandemic, to simplify and liberalize some of India’s rigid labor regulations.

-

42

The Indian government aims to strengthen its “Make in India” campaign and the “self-reliant India” initiative in the next five years to boost local manufacturing. With nearly INR 2 trillion (US$25 billion) allocated to the production-linked incentives (PLI) scheme by 2025, 14 sectors, including medical devices, consumer electronics, and white goods, are targeted. In 2022, the PLI outreach was expanded to solar modules and semiconductors. These initiatives, alongside the temporary corporate tax rate cut for new manufacturing companies introduced in 2019, are expected to have a more visible impact on the economy after 3-5 years. However, challenges in the business environment, such as land acquisition and competition for FDI from South-east Asia, will persist.

The e-commerce market is anticipated to attract substantial FDI over the next decade, with US and European firms seeking to establish a presence. The Reliance Jio platform, boasting over 430 million subscribers, offers an attractive entry point for foreign firms into the Indian online technology market. Although Chinese investors used to be active participants in Indian internet start-ups, structural tensions between China and India have led to a significant reduction in their presence. Stricter investment requirements from bordering countries have slowed Chinese capital inflow, but not stopped it altogether. Long-standing tensions at the disputed border with China will likely continue, reinforcing India’s nationalistic posture and banning companies from border countries from bidding on public contracts.

India’s labor market is set to undergo a significant transformation. The driving factors behind this positive change include relaxed labor laws, enhanced workforce skills and health, and improved wage levels.

In 2020, the government passed four new labor codes, addressing wages, social security, health and safety, and industrial relations. Although their implementation is still pending, these codes have the potential to substantially impact the business environment by consolidating around 75% of the 40 central government laws that currently govern the labor market. While firms will still need to navigate state-level legislation, the four codes will establish a standard baseline for states to follow.

One notable area of liberalization is in industrial relations laws, which will increase the threshold at which companies require government approval before laying off staff. The current threshold, a remnant of colonial-era rules, has significantly disincentivized firms from growing beyond 100 workers.

The government’s skilling programs aim to up-skill the workforce and improve the quality of workers available. However, the subpar level of primary education in India may impede rapid progress. Additionally, the migration of qualified Indians to the West may create a skills gap. Despite these challenges, India’s workforce is expected to be far more productive than those in other South Asian countries.

While the benefits of these labor market reforms may only become apparent in the medium to long term future, progress may be hindered by opposition from trade unions, including those affiliated with the BJP. Furthermore, the participation of women in the labor force is likely to remain constrained. As India navigates these challenges, its labor market transformation will play a crucial role in shaping the nation’s economic future.

0.27 $

2.29 $

172 $

2.1817 %

India’s corporate tax rates have witnessed a significant decline from around 50% in the early 1990s to more reasonable levels today, reflecting the government’s efforts to broaden the tax base and ensure greater compliance. The government has introduced several initiatives to reduce tax avoidance and promote compliance, such as the gradual reduction of the corporate income tax rate from 30% to 25% and the introduction of the “place of effective management” (POEM) concept. The Finance Act 2022 has left corporate tax rates unchanged, providing companies with five different tax options, including a standard corporate income tax rate of 30% for domestic companies and 40% for branches of foreign companies.

Efforts to tackle tax avoidance include renegotiating several double-tax agreements and cracking down on shell companies suspected of illegal fund flows. The POEM concept has been introduced to limit tax avoidance through corporate structures involving offshore low-tax jurisdictions. As of 2017, a company is considered resident if it is an Indian company or its POEM is in India during the year. The Central Board of Direct Taxes issued detailed guidelines for determining the POEM in 2017.

To streamline indirect taxation, the Indian government introduced a Goods and Services Tax (GST) in 2017, which replaced most national and state-level indirect taxes. The government has also taken steps to improve dispute resolution and reduce pending tax-related litigation, such as dissolving the Authority for Advance Rulings (AARs) and constituting new Dispute Resolution Committees for small taxpayers. The 2022/23 budget further encourages voluntary tax compliance by allowing taxpayers to submit updated income tax returns within 24 months from the end of a relevant assessment year, after paying additional tax.

India’s infrastructure environment is expected to see a significant improvement. This improvement will primarily be driven by faster broadband speeds, more extensive transport infrastructure, and a more reliable power supply. The NDA government considers infrastructure improvements and expansion as key priorities, with public investment primarily directed toward transport, energy, and urban development projects. However, the progress of ongoing projects may be slowed by land acquisition challenges and delays in regulatory clearances, particularly environmental approvals.

The 2022/23 budget allocates a substantial capital expenditure of INR 7.5 trillion, targeting crucial sectors such as defense equipment, atomic energy, telecoms, metro rail projects, railway infrastructure, affordable healthcare, and the National Investment and Infrastructure Fund. Infrastructure will remain a priority in the government’s spending mix throughout the next decade, with the establishment of the National Bank for Financing Infrastructure and Development to spur construction activity. While delays may persist, completed initiatives will ultimately strengthen domestic goods and labor flows.

India is set to enhance internet speed and connectivity, with the percentage of the population using the internet rising from 8% to 43% between 2010 and 2020. Despite this progress, there remains a significant disparity between rural and urban India in terms of internet penetration. The government will continue to lead infrastructure development, with urban civic infrastructure projects hampered by inadequate private sector involvement due to limited returns on investment.

Two publicly funded connectivity projects, Bharatmala (road construction) and Sagarmala (port construction), will remain prioritized. The first phase of Bharatmala aims to connect 550 of the country’s districts through the highways network, up from 300 in 2017. The government has plans to build highways totaling 18,000 km over 2022/23. While a lack of capital investment hinders railway capacity expansion, a mild pick-up is expected during the forecast period. As India continues to invest in infrastructure, the country’s future economic growth and competitiveness will be influenced by its ability to overcome existing challenges and successfully implement these ambitious projects.