Recent growth of Vietnam has been nothing short of impressive

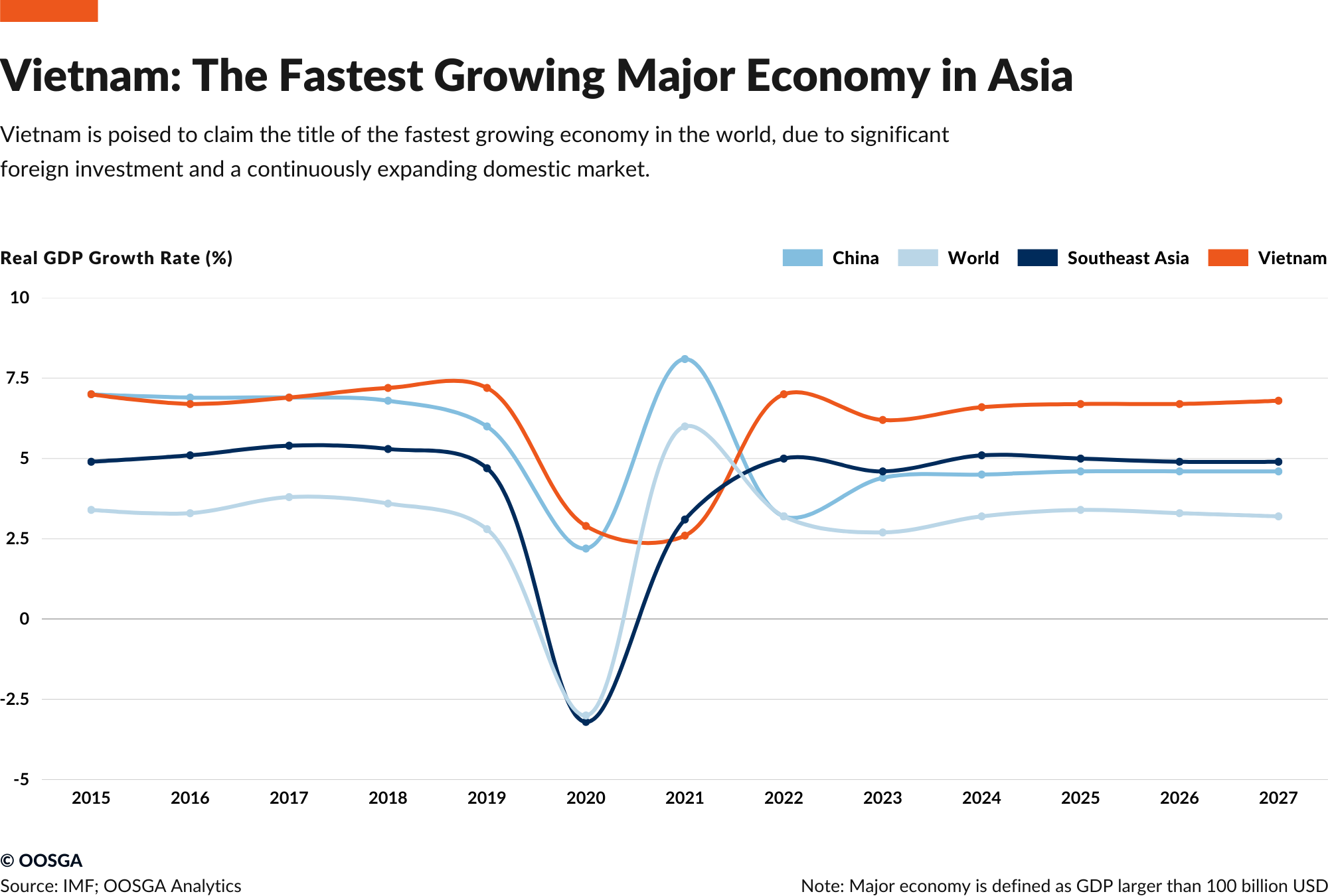

Vietnam’s economy has been growing rapidly despite the ongoing Sino-US trade war. The transfer of manufacturing supply chains from China to Vietnam has been a major contributor to this growth. In 2020, in face of the global pandemic, Vietnam still managed to maintain a growth rate of 2.8%, which is remarkable among major economies.

Although the annual growth rate will drop to 2.58% in 2021 due to the impact of the domestic Delta outbreak and government’s epidemic control measures, the overall trend of economic development remains unchanged. The Vietnamese government estimates a growth rate of 8% for 2022, which is nearly twice the ASEAN average of 4-5%. Also, throughout the next five years, Vietnam’s GDP is projected to grow at an average rate of 6.7%, which is two times the world average in the same period.

The country also boasts a relatively complete business and infrastructure, with a high level of domestic political stability due to its one-party dictatorship. This gives it an edge over other competing economies, such as Indonesia and the Philippines, Laos, Myanmar, and Bangladesh. The Vietnamese government has also signed a nine-year infrastructure construction plan, which is expected to improve roads across the country and launch 5G infrastructure development in early 2023.

With a growing economy, a robust infrastructure, and a competitive business environment, it is easy to see why Vietnam is such an attractive market that many are actively get into. However, there are a few things we would like to note and some trends that will shape the market in the coming years. So that, you can develop a more comprehensive market entry or operating plan that are sustainable and lasting.

Demographics with Changing Dynamics

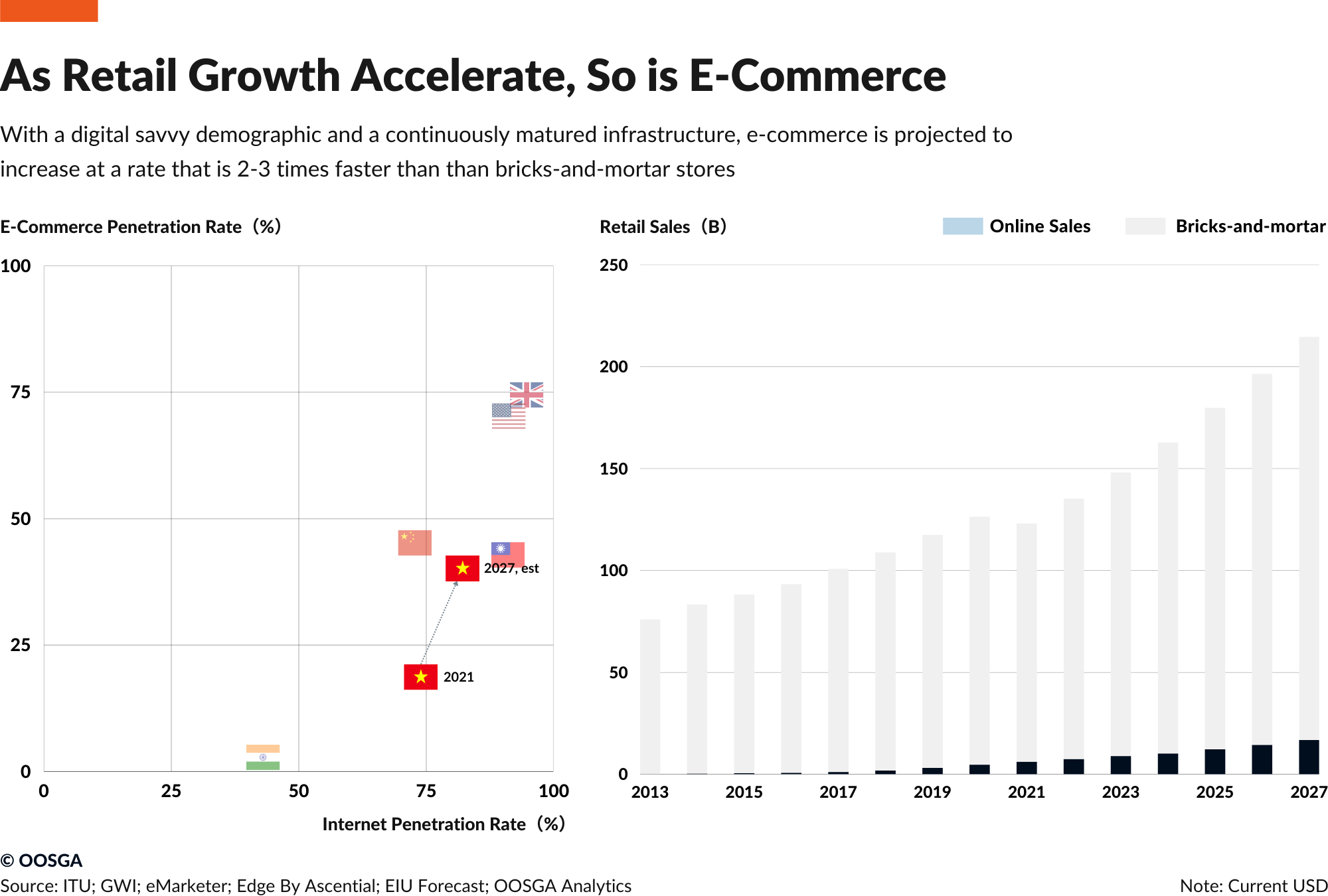

The first thing to note about the market of Vietnam is its demographics. The country is still changing rapidly. Similar to China in the late 2000s and early 2010s, the demographic structure is changing, people are getting wealthier, mobile and internet is penetration every aspect of people’s lives.

However, different from that of China, Vietnam does not have to figure things out on their own. Most technologies are present and some even matured. Take internet penetration rate as an example, according to ITU, Vietnam have had a higher internet penetration rate ever since 2017, comparing with China. The Smartphone usage is also really high as government has been continuously rolling out policies that push the use among the general population.

This translates directly to a potentially strong consumer demographics that supports e-commerce and various other online activities. However, since the infrastructure in most second tier city and rural areas are still lagging, there is only an 18.7% of Vietnamese use the e-commerce.

It does imply a strong growth over the coming years though. As more and more people are engaging commerce online, and more and more people are getting richer, we expect the e-commerce market will grow substantially faster than their regional peers. In fact, over the past decade, the e-commerce market has grown an average rate of more than 60%, according to our estimate with data aggregated from Euromonitor, eMarketer, and Edge by Ascential.

A Large Population and a Growing Middle Class

With a population of 100 million, Vietnam is the 3rd most populous country in Southeast Asia, only after Indonesia and the Philippines. With a healthy fertility rate and 2.1 and an advantageous demographic structure, there will be a working population that increases over the coming years.

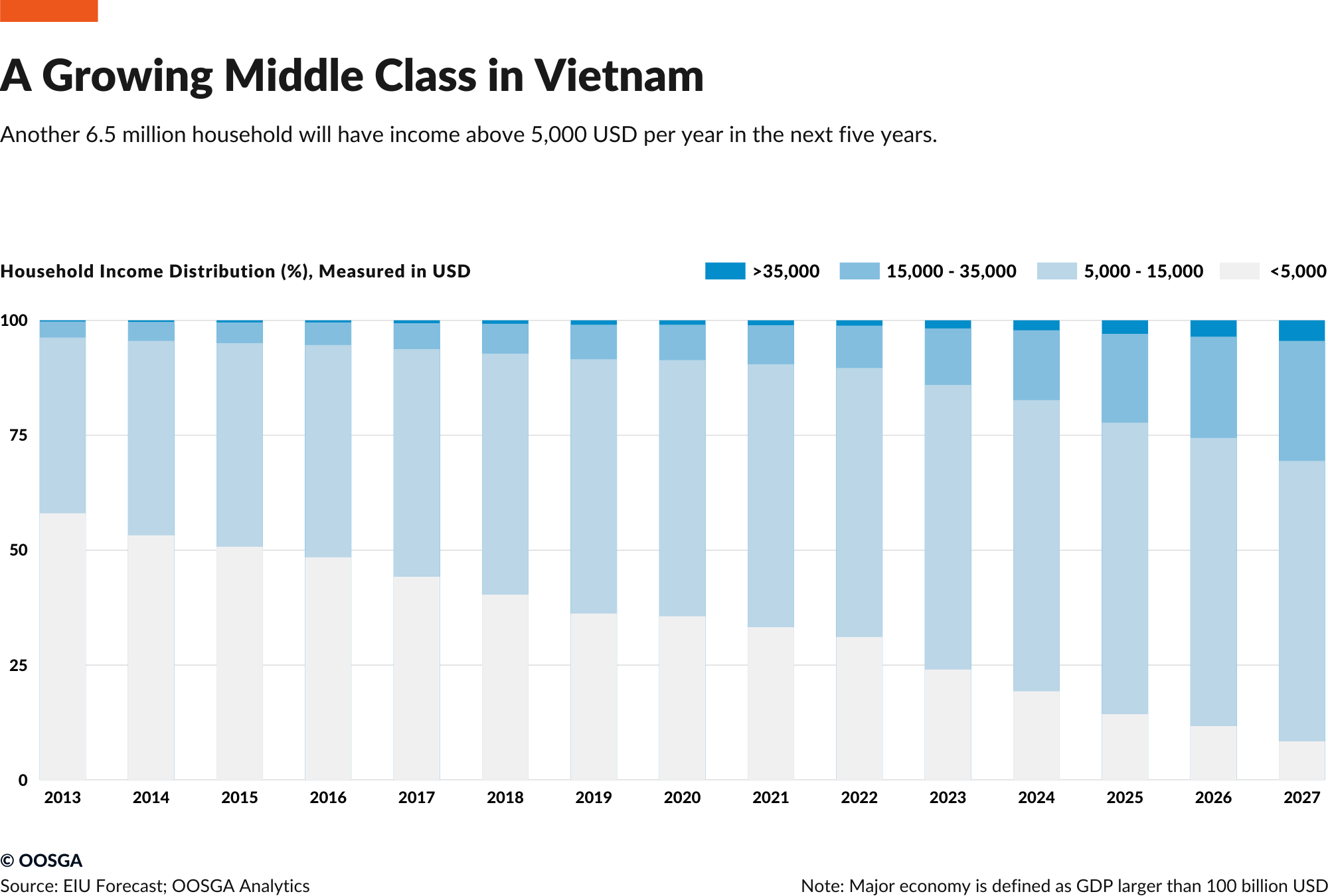

As the economy of Vietnam is reaping the demographic dividend, more and more people are getting richer as a result. From spending perspective, data from World Data Pro, an Austrian intelligence firm, has suggested that there will be an additional 36 million Vietnamese that spends more than 11 dollars a day, in the next decade.

Also, household income data has also suggested in the coming five years there will be an additional 6.5 million household with more than 5,000 USD disposable income.

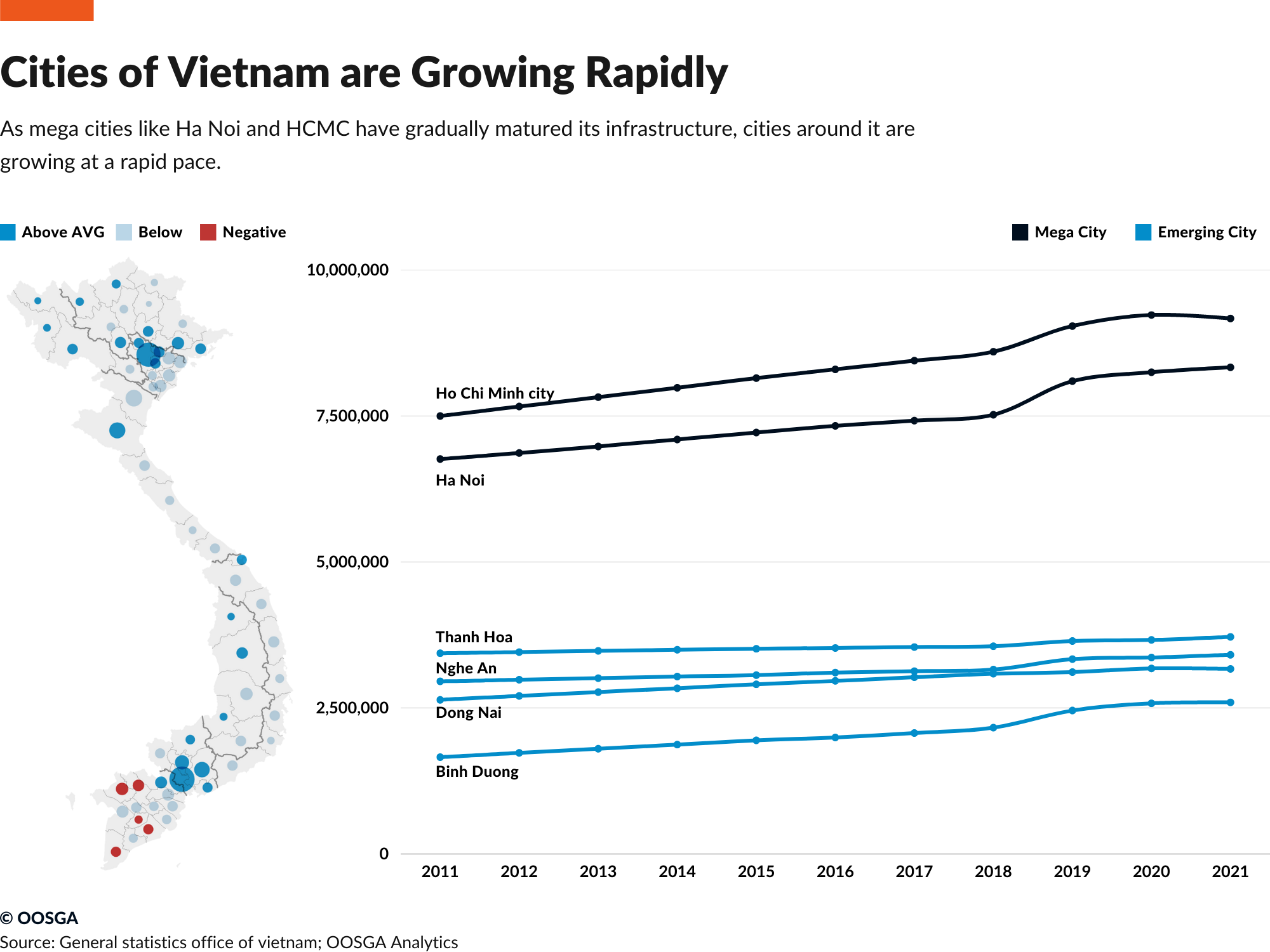

Geographic Spreading

In terms of its geographic, Vietnam has been known for their two mega cities – Ho Chi Min City and Hanoi. While that has been the case for a long time, other cities are also booming as a result of mega cities lacking relevant resources such as land to keep up the accelerated demand.

Take FDI as an example, Binh Duong, a city north to Ho Chi Minh has taken in a total of 31.7 billion dollars in 2018, which is almost the same as Hanoi, and about what Shanghai and Beijing combined. This kinds of velocity has sped up the city’s developments. Binh Duong’s pouplation even grew at the rate that is almost five times that of the country and two times that of Ho Chi Minh.

The days of focusing solely on Hanoi and Ho Chi Minh City are over, except in high-end luxury sectors. Local industries are now targeting consumers in rural areas across multiple cities, so companies that only serve the two largest cities will need to expand their approach. To reach about 50% of the population with incomes over $15,000 per year, companies typically need to distribute their products to a dozen of relevant cities from North to South.

What Do They Buy?

Now that we have a comprehensive understanding of who the Vietnamese consumers are, the next question naturally is what do they buy?

In our findings, we found that in Vietnam, the consumer market is largely dominated by the food retail industry due to the low income levels of the population. This is similar to that of the Philippines. The prediction is that spending on food, drinks, and tobacco will make up almost 40% of total expenditure in 2023, which will be slightly higher than the pre-pandemic level. However, this percentage is expected to gradually decrease over the years.

Vietnam has about 27% of the workforce that is involved in farming, according to the statistics published by the ILO. However, just before the pandemic, the same figure is around 37%. This is mostly due to the increased rate of investment into the Vietnam’s cities as a result of many diverting away from China. Vietnam is still largely dependent on agriculture, with rice being a staple food and a major export. Other notable food exports include seafood, coffee, tea, pepper, vegetables, fruit, sugarcane, and cashew nuts. Robusta coffee is also produced in large quantities in Vietnam.

The demand for packaged foods has increased, especially during the pandemic, with convenience foods, baked goods, snacks, and dairy products being among the fastest-growing categories. However, many food items are still expensive for the population due to their low income levels compared to other Asian economies. The consumer price inflation rate increased gradually in 2022, with around two-thirds of the rise being driven by food inflation, which hit a two-year high in December.

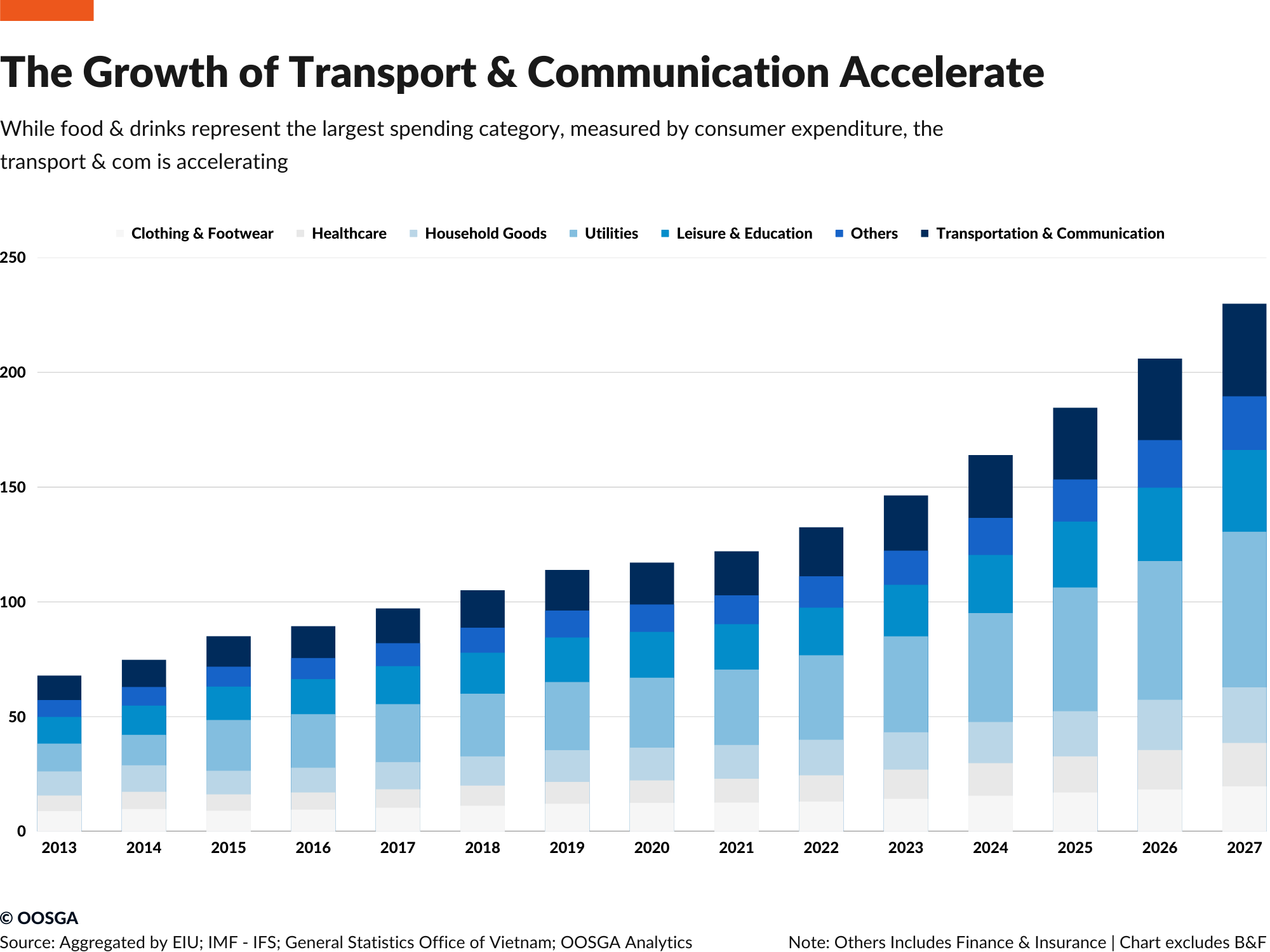

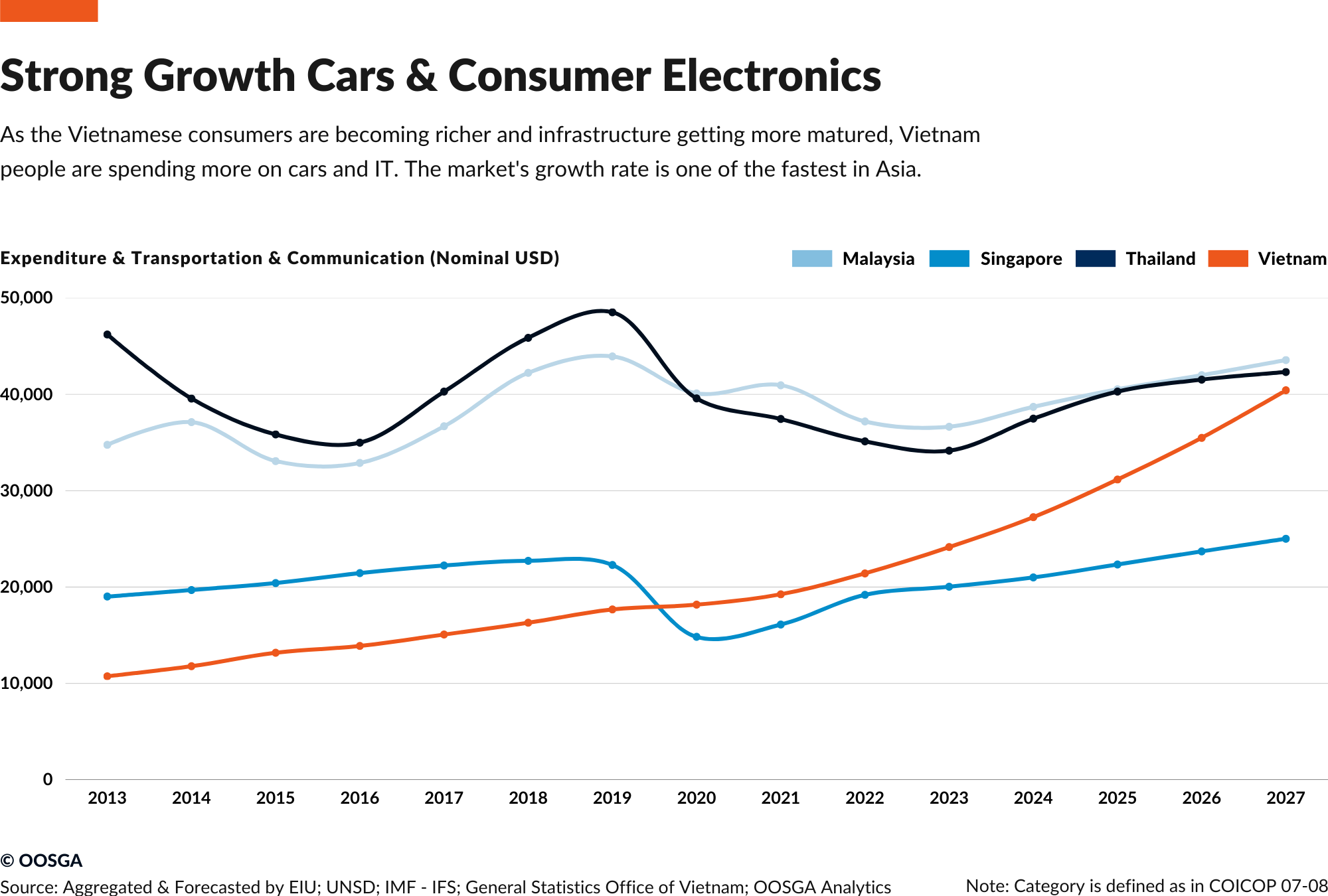

Despite foods & drinks make up the largest part of the consumer expenditure, the spending structure is gradually shifting. According to a prediction published by the EIU, spending on foods & drinks will eventually decreased to 36% in five years from 40% in 2022. In turn, utilities, cars, and IT will make up a larger sum of the spending.

In our findings, we also further discover how the Vietnamese consumer spend has a strong association with the trends of demographic shiftings. That is, people getting richer, elder, and more global influenced in terms of culture. Among the key segments, our takeaway includes the following:

Structural Shift in Consumption

Consumer electronics demand in Vietnam will be robust, with infrastructure improving, such as 5G in the city or cellular in the rural areas, in the coming years. Samsung dominates the smartphone market in Vietnam, while Oppo, Xiaomi, and Vivo are popular for low-budget smartphones. After Apple losing out on the market, beaten by Samsung, it is now actively getting back more and more market shares.

Vietnam is an important exporter of finished clothing, overtaking Bangladesh as the world’s second-largest exporter of finished garments. Apparel and footwear will further increase with an estimated CAGR that is close to 8% in the coming five years.

Cosmetics and toiletries sales are growing in Vietnam, with rising disposable incomes. LG Vina Cosmetics, Pond’s, and Nivea have a significant market share, while Asian brands such as Innisfree, 3CE, and Shiseido are expanding, According to Euromonitor Passport.

Consumer spending on household goods and furniture will increase by about 9% CAGR between 2023-27. Major foreign appliance brands such as Samsung, LG, Haier, and Panasonic are likely to retain a significant market share. One thing to note, over the years, Vietnam has also become a major exporter of processed wood products, especially furniture.

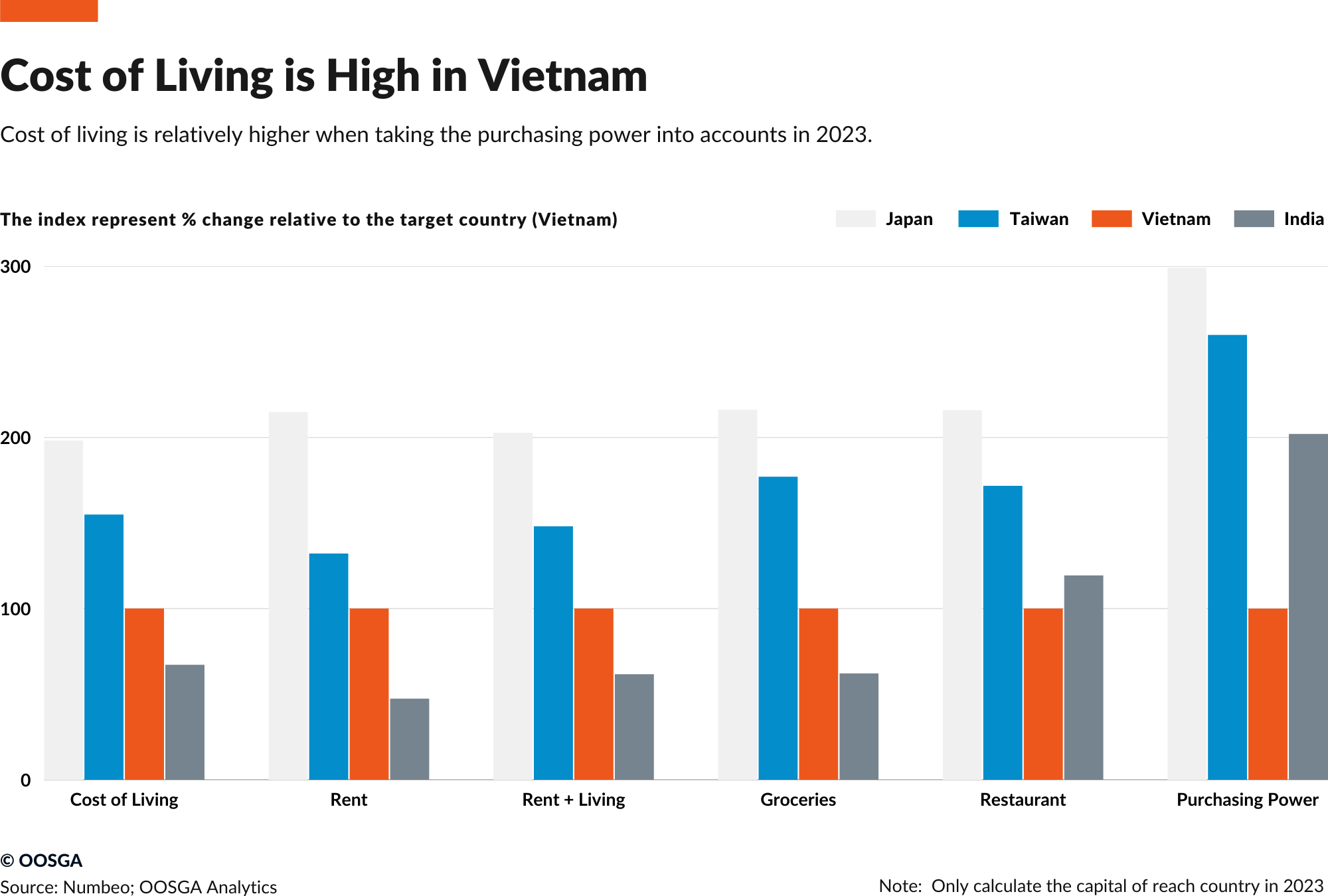

Higher Cost of Living

The population in Vietnam faces relatively expensive food prices due to lower income levels compared to other wealthier Asian economies. In 2022, consumer price inflation rose gradually and persistently, reaching 4.5% in December from a low of 1.8% a year earlier. The rise was mainly driven by food inflation, which reached a two-year high of 5.2% in December.

The prediction is that the average inflation rate will continue to increase to 3.9% in the current year, up from 3.8% in 2022.

Where Do They Buy?

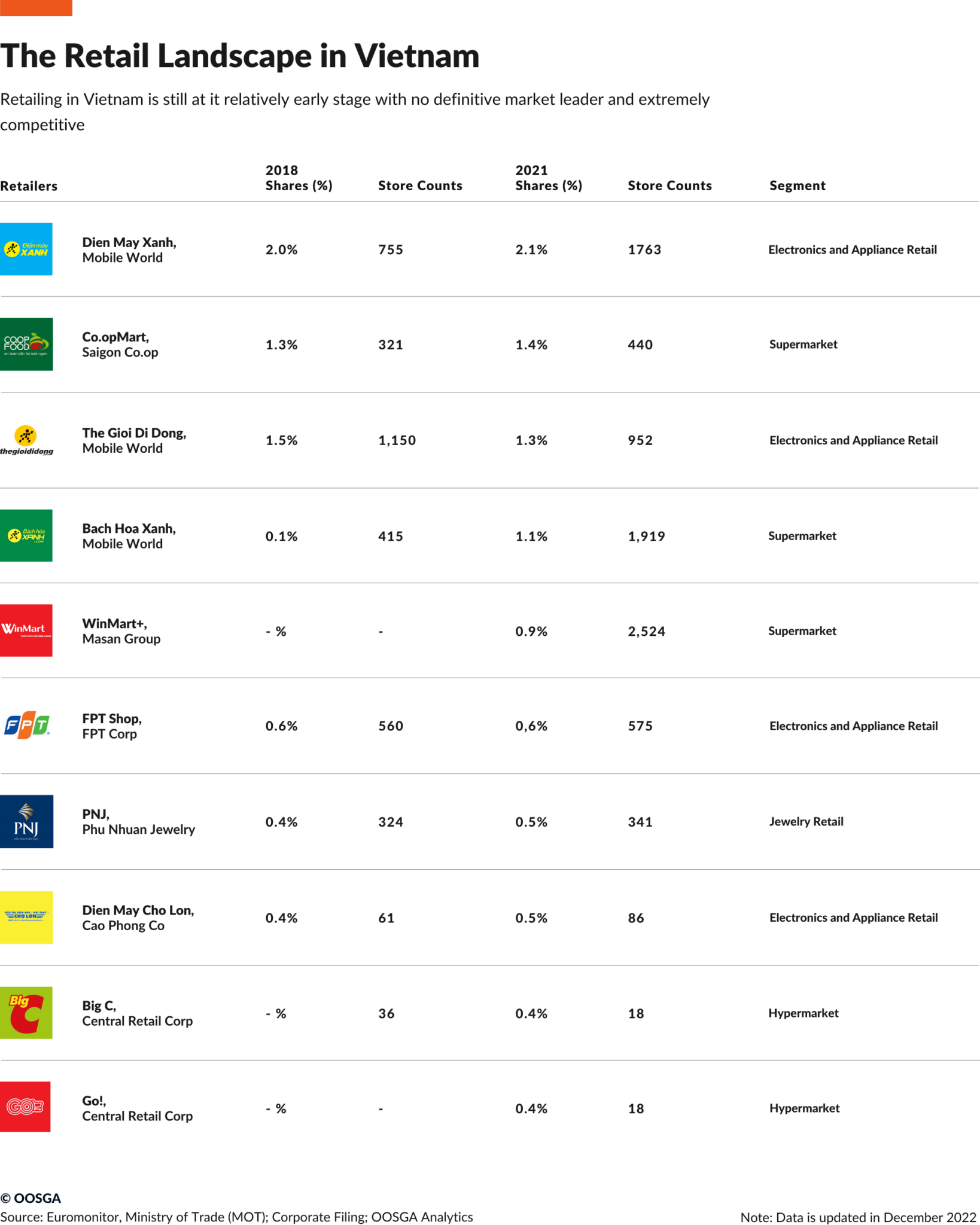

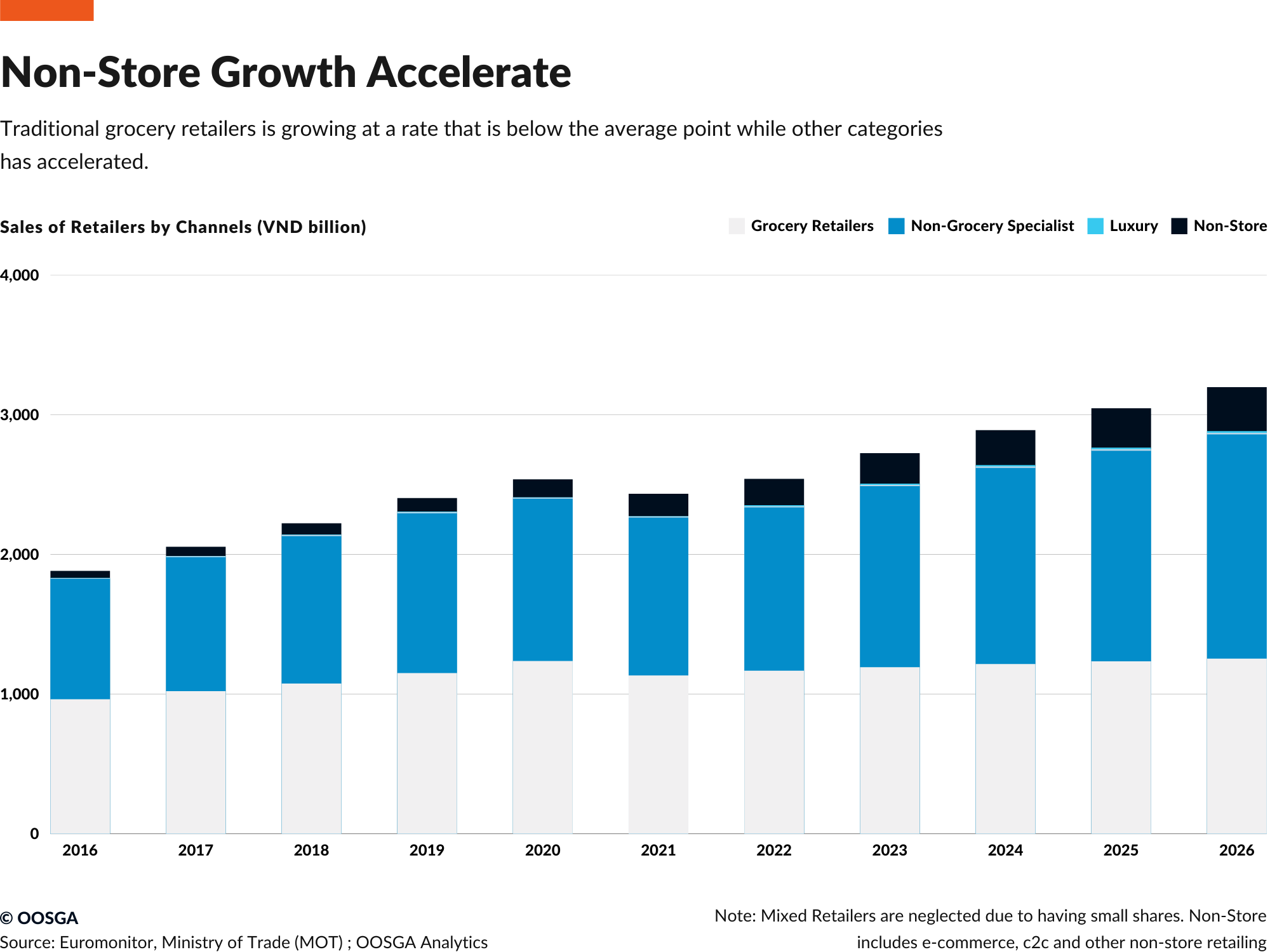

In terms of the retail landscape, the deployments of many retailers are also strongly associated to what they shop and how they shop it. For example, as a result of foods & drinks losing shares, the grocery retailers also share a slower growth over the years.

Over the last six years, not only do we see non-grocery specialists growing at a much faster rate of 5.5% CAGR. The mixed retailers and the luxury retailing segment is also accelerating its growth.

However, the fastest growing segment is no doubts its e-commerce. Over the years, Vietnam has established a robust infrastructure in its major cities and is now spreading to other parts of the country. Additionally, the Vietnamese government’s efforts to encourage e-commerce adoption will likely drive growth among those who do not typically use e-commerce. The government’s plan targets increasing e-commerce usage among the population to 55% and per capita e-commerce spending to approximately $600 by 2025.

Retailers are making investments to take advantage of the rebound in spending. Popular grocery retailers include Saigon Co-op, AEON, and MM Mega Market. AEON plans to open 100 supermarkets by 2025, up from seven in early 2023. The largest organized retailers include Central Group, Mobile World Group, and Masan Group, which recently acquired Vingroup’s retail operations. Central Group intends to invest US$825m by 2026 to enhance its presence, with a goal of reaching US$2.7bn in revenue. Online players such as Shopee (Singapore) and Mobile World Group’s Gio Di Dong also hold significant market share.

The retail market in Vietnam is experiencing a surge in merger-and-acquisition activity by regional and domestic giants. In 2021, Alibaba and other partners invested US$400m in Masan Group. In the largest deal of 2020, Masan Group acquired an additional US$1bn stake in CrownX, its joint venture with VinCommerce, to increase market share in the grocery segment. CrownX also received additional investment from TPG, the Abu Dhabi Investment Authority, and SeaTown.

Retailers from Japan and South Korea are increasing their presence in Vietnam, partly due to the country’s long-standing FTAs with those two developed markets. The Regional Comprehensive Economic Partnership (RCEP) is expected to speed up these efforts, while Vietnam’s ratification of the Association of South-East Asian Nations (ASEAN) Trade in Services Agreement in 2021 should encourage investment from its closer neighbors. This agreement has a “negative list” approach, which means that all service industries are automatically liberalized. As regional trade deals are implemented, imports are expected to become progressively cheaper.